Techonomics Newsletter #1

7/19/20 - China, India, the EU, and International tech; Twitter's hack; a few bites

Hey all,

Welcome to the first newsletter from Techonomics. It’s been a very busy week with, amongst other things, tech and the economy, and I am excited to share some of my favorite finds for the first time.

I will send out this newsletter every Sunday evening so you can get the previous week’s tech bites at a time where you aren’t bombarded by everything else.

Additionally, I am going to provide more original content and posts that will cover items like a tech segment deep dives, salary negotiations as an engineer, and how to evaluate your friend’s idea.

As with all Techonomics newsletters to come, I hope to improve each offering to make this as useful as possible to anyone who’s reading. If there’s feedback, please email me directly at dejno@techonomics.news, and if you want to subscribe, click below.

Enjoy!

— Dejno

One longer take

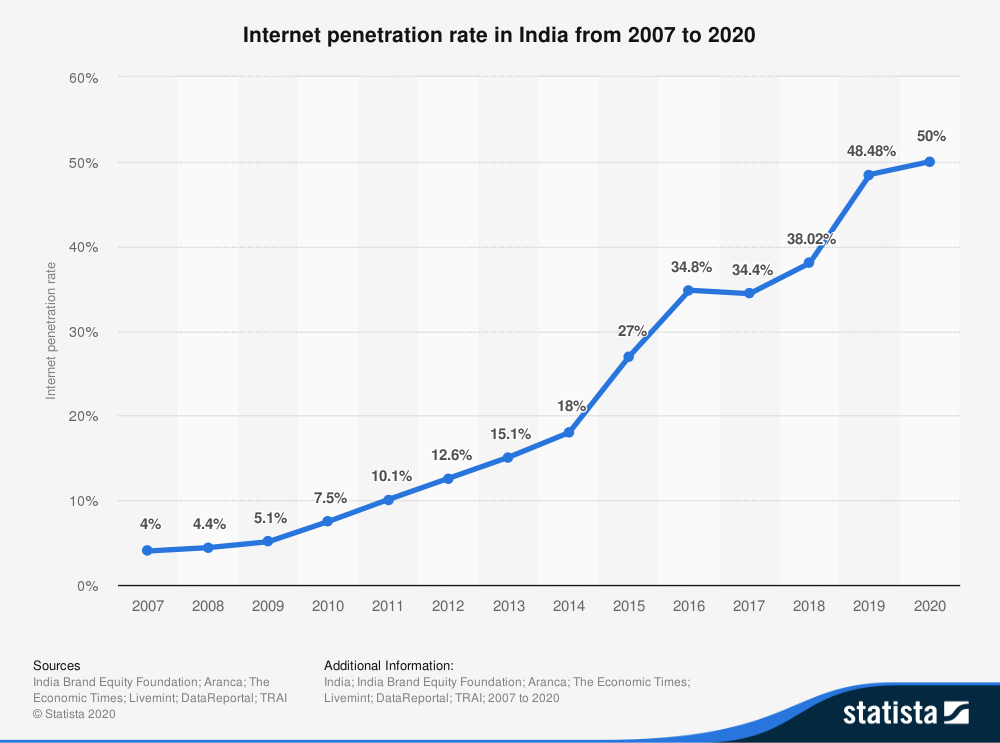

India is where it’s at for tech investment: India tech investment and growth is exploding as more of the population gains access to the internet. With China and tech companies feuding, tech companies are looking at India’s low, but growing, internet penetration as an opportunity to gain global market share. Large tech is trying to capitalize: Google investing $10 billion, Facebook investing $5.7 billion in Jio, and Amazon investing $1 billion in digitization of small/medium sized companies. Walmart is even investing $1.2 billion in India’s e-commerce darling, Flipkart. Everyone wants a piece.

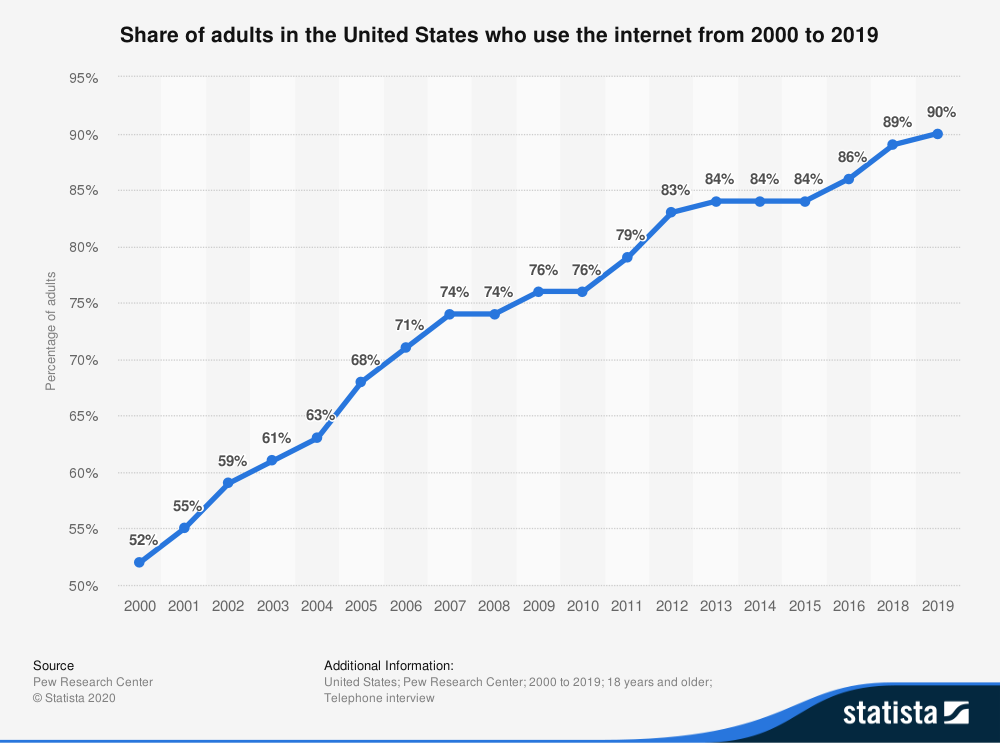

In fact, if we look at the USA, we can see there’s a 90% internet penetration rate with adults in 2019 which means that we have roughly 295.5 million people (90% of 328.2 million) using the internet. (Here’s the 2017 overall internet penetration as well, at just under 90%, to show that the adult population is representative.)

While in India, we see a 50% penetration… 20 years after the US hit that same number. While in absolute values, India internet usage is huge, around 690 million (50% of 1.38 billion total population), getting that next 690 million people online means lots of opportunity. More than double the opportunity in the US at full market penetration. Also, compare the shapes of the two graphs.

As countries become more saturated with internet usage, you start to see the Apple predicament: when you’ve hit diminishing returns or slower growth (in Apple’s case, the iPhone), you turn to new ways to leverage current assets in new way to grow (Apple Services). In this case, we see global expansion of new and existing products into new global markets for the big tech companies, and disruption from startups. The next question is, what’s the spend per user?

Interesting reads

The local internet: Privacy and localization of the internet is continuing. While there is recent focus on China and Beijing, privacy, and the use of TikTok ($), the EU set the stage in a court ruling that invalidates the Privacy Shield agreement between the US and the EU. Meaning if you are an EU citizen, your data needs to stay in the EU.

This is going to be a massive headache for tech companies across the globe, but will likely be met with some form of opposition by large tech conglomerates, who are more well suited than anyone to deal with it. What about small cap tech or startups? They’ll likely have to shift their technology or buy the latest product from Amazon, Microsoft, or Google cloud services to help with geo constraints. (link $)

But what’s the motive here? Is it anti-surveillance? Another story around acquittal of tech giants from tax litigation, when in combo with the story on the Privacy Shield, means that it is mostly a data rights issue, but one with long reaching implications to get data centers under local control. Tech companies will pay their tax regardless, it’s just now in infrastructure, marketing, and associated costs with splitting EU citizens from the larger pie. (link)

What’s in a hack? Twitter made headlines with a list of highly visible compromised accounts from the likes of Jeff Bezos and Barack Obama. Initially, this is a play to get bitcoin, but access to accounts means access to DMs and other personal info. We may just be getting started on this, but the important part here is what is meant by a “hack”. In this instance, it’s not someone gaining access to the system from the matrix: it is social engineering preying on human faults. MFA or 2FA won’t help here. (link)

Budget “COVID” cuts are curtailing innovation: According to the WSJ, AI budgets are decreasing as of Q2.

The survey, released last week, found that the CIOs expect spending on AI, machine learning and process automation projects—which Morgan Stanley put in one group—to increase around 7% this year. That’s down from an increase of about 11% that CIOs predicted in Morgan Stanley’s first-quarter survey. The most recent survey was conducted during May and June.

This is likely due to the overall decrease in shrinking tech budgets, even if investment allocations toward Cloud and AI are increasing, to deal with the fallout of COVID-19. Slightly orthogonal, this reminds me of continued use of farm workers while wages were low due to lack of unionization before the 1950’s, rather than pushing for mechanization and improvements. If it’s too expensive to do one thing, you will start doing the other. In this case, this is tipping the scales in the opposite direction of innovation. (link $)

Visualizing big tech’s money machine: Good information on how the big tech giants make their money. Interesting breakdowns that are keeping investors honest, like Amazon’s 12.5% AWS segment or the overwhelming ad revenue as a share of profits for Facebook. (link)

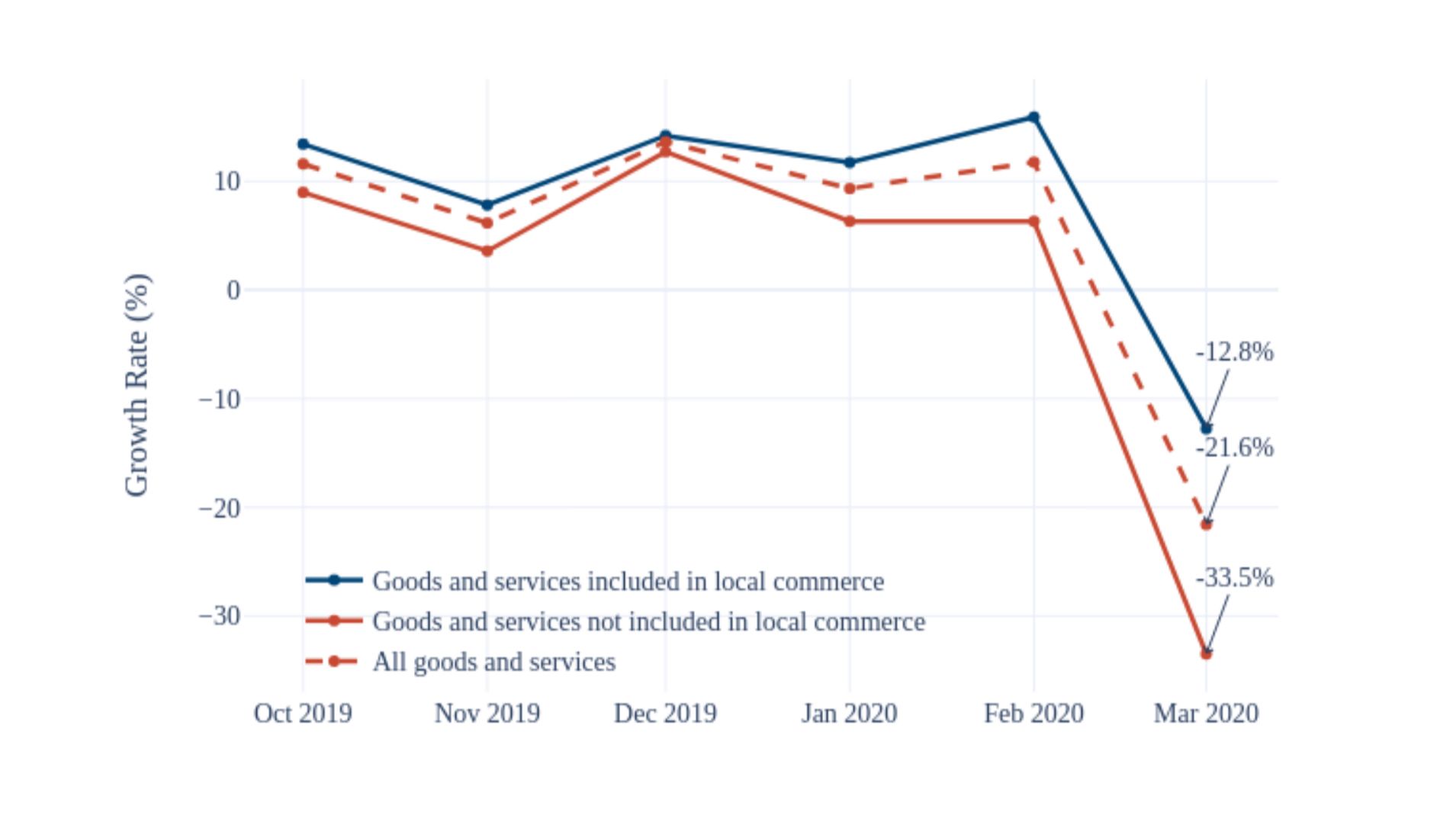

Online v. Local CC spend in COVID times: It was found that consumers in this large sample that responded to the pandemic in March by decreasing their overall spend on goods and services on credit cards by 21.6%. That’s a huge percentage decrease. My guess is that this is improving right now, but if we extrapolate this out for most Q2 earnings reports, it’s likely we will see some not-great results. (link)

Robinhood investors vs the institution: Does Robinhood have an outsized impact on market trajectory? From total number of trades on Robinhood, it’s unlikely to have a large impact, however, in one hypothesis there may be an additional vector when there’s blame on retail investors. (link)

From the article:

But there is perhaps one market structure explanation which goes something like this. Some corners of algorithmic trading buy and sell on price signals alone, which is often referred to as “momentum trading” (although not always). In this instance, the robots might spot a stock rocketing from a few giddy retail buyers and jump aboard, which creates a feedback loop where less knowledgeable retail traders join in, bringing in less sensitive algorithms, and then more cautious day traders, and so on.

As someone who has used Robinhood to get into the market years ago, I see its value. However, it’s been in the news a lot lately concerning its impact on retail investors and markets, but most importantly, the extremely sad news of a trader’s suicide. Robinhood will need to think thoroughly about its product offering and what ethical and moral obligation the company has to ensure education of the new retail investors it enables.

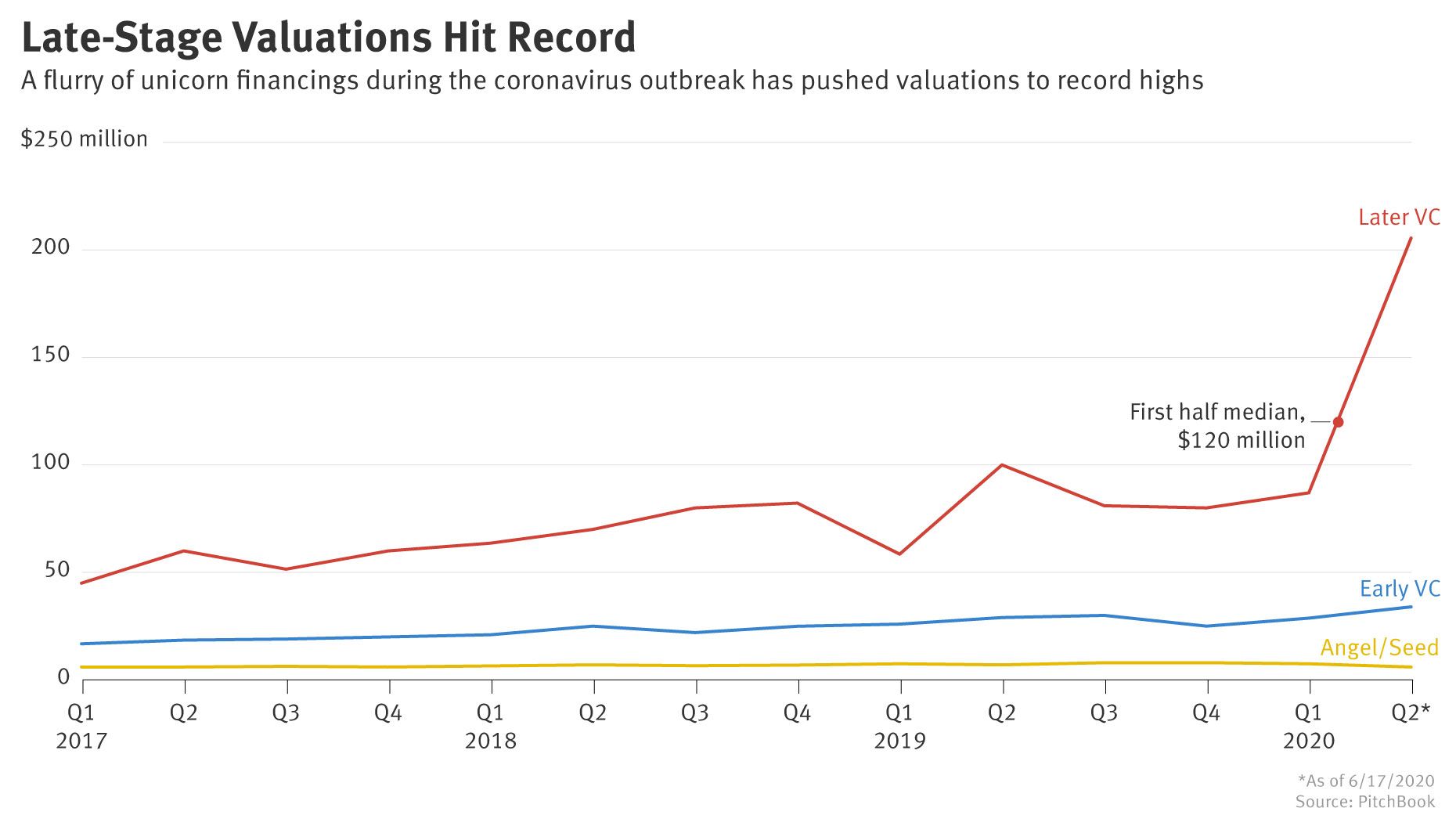

Big Tech and disproportionate investment during times of risk: Angel and seed investments are down 50% YoY. While I don’t think this is earth-shattering, and I expect this to improve, given the uncertainty that goes along with angel and seed rounds of investment (i.e. if you invest earlier, it’s risky) matches the COVID-19 uncertainty, it does show that there’s been a shift of investment to larger tech firms. (link $).

Moore’s Law, cont’d: a-BN 2D insulation for transistors on silicon chips. Really cool, high level read on the continuation of Moore’s Law with the help of new tech. There’s still more room for growth and competition in the chip market. (link $)

Bites

Great mini-cast from Naval on product and media leverage (link): The new leverage is not capital and labor, but knowledge to build product and the creation of evergreen content. What can work for you while you sleep?

Every great software developer, for example, now has an army of robots working for him at nighttime, while he or she sleeps, after they’ve written the code and it’s just cranking away.

Great tweet/thread/moment about about Radical Candor: We all have blind spots and areas of improvement. Being honest about that and asking for help can go a long way.

Using respiratory acoustics to show COVID-19 symptoms: Cool. (link $)