Techonomics Newsletter #2

A music streaming partnership, antitrust claims, SPACs, and more

Hey all,

Welcome to the Newsletter #2 from Techonomics!

This week we have a bunch of new content around music streaming, SPACs, antitrust claims, and more. We also have some follow-ups from Newsletter #1.

For this week, I wanted to lay out the format we will be following together.

- Longer Take as a deeper analysis on something that’s particularly interesting over the last week.

- Interesting Reads which will be a shorter analysis accompanied by a link.

- Bites which are simply a one liner and a link or graphic.

- Follow-ups which help tie in the newsletter from previous weeks as I correct and reinforce past hypotheses.

I am still balancing between the sheer amount of links and the length of analysis to include. I will be playing around with this in the coming weeks, so if there’s feedback, please email me directly at dejno@techonomics.news.

Enjoy!

— Dejno

One longer take

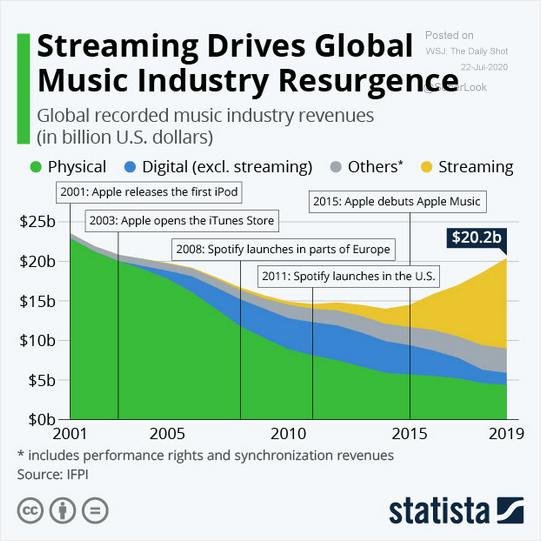

Music’s format journey → Physical to Digital to Streaming: Napster was founded in 1999 and so began the digital transformation from physical to digital through piracy, and the coming loss of record label revenue until a low in 2014, just shy of $15B. With the creation of a platform that made it extremely easy (free?) to upload and download music, Napster was a catalyst for the digitization of music. With the addition of iTunes in 2003, we saw a large increase in the number of legal digital downloads that fell quickly with the introduction of streaming thanks to Spotify in 2008. Since 2011, we have seen a strong, consistent shift to streaming services.

There’s a lot to unpack here. Over the past ~20 years we have seen a few abrupt shifts in consuming music. Napster digitized music, but had a hard time with legality. iTunes continued the trend and, thanks to Steve Jobs, began the monetization and broad distribution of digital music for the record industry, whether they liked it or not. As technology improved and the internet increased market penetration, streaming services came and changed the way we access, as opposed to owning, digital music.

What’s interesting here is how quickly the digital downloads were upended by the complete takeover of the industry by music streaming services, led by Spotify. While it hasn’t been the most clean relationship between Spotify and the record labels, it shouldn’t be overlooked that Spotify and other streaming services have helped to bring the music industry back to its feet from that $15B low in 2014 to $20B in 2019.

When piracy was destroying physical sales, even during the period of iTunes downloads, the new ability to stream an entire global catalog of music available to you made things much easier. At the price point of roughly $120/year, the effort and risk of downloading illegal music increased relative to the overall cost of streaming. While piracy will never go away, the music industry will battle against it. What better way to do so than to reduce friction, differentiate your offerings, and reach your listeners where they are? That’s what we see with music streaming.

This leads me to the news this past week from Spotify and Universal Music Group who inked a deal to partner on the development of marketing tools that also had a positive impact on Spotify’s stock price. While this isn’t the first deal we have seen between Spotify and UMG, this announcement cannot be overstated. As discussed in the previous paragraph, Spotify and it’s record labels have not always had the best relationship, and rightfully so. It’s hard to navigate change, shift distribution strategy, and give a portion of profits to partners. The most important part here, however, is the mental shift of the music industry to leverage the Spotify platform in which their music is being distributed and consumed.

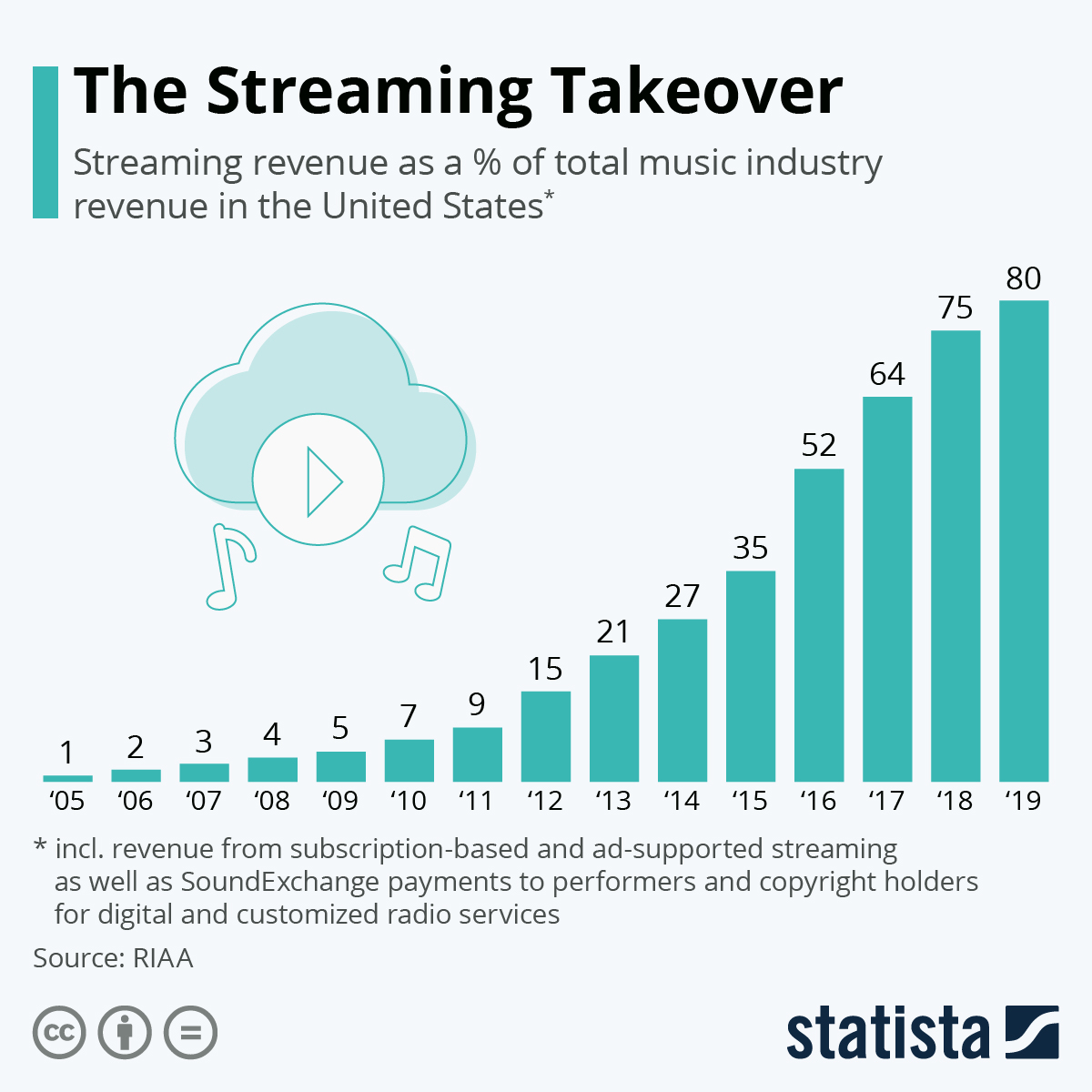

This huge shift in perceived value of a platform from one of shared profit and distribution to one of a data-driven marketing platform is a smart one. It also rests on the overall percentage of profits for the music industry attributed to streaming we saw in the above visual and the below:

Technology continues to evolve industries, and kudos to Spotify for building a stellar consumer experience for the music industry, gathering differentiated industry data from its 286 Million MAUs, and then selling that data and tools to the record labels to increase reach, and ultimately, the success of new label releases through targeted marketing. Without Spotify’s growth and market dominance in streaming, it’s unlikely that there would even be enough data for this new marketplace. Both parties working together on marketing tools that leverage the models of push notifications, emails, and whatever else Spotify and UMG can think up for in-app on top of the data provided by the large and growing Spotify customer base will help Spotify continue to build a dominant platform while increasing record label revenues.

The evolution of the platform and content provider partnership here is not done, and I will be anxiously waiting to see how it shifts. I have always wondered if we will see an unbundling of sorts when it comes to each music label, similar to what we have seen in video streaming. However, given Spotify’s lack of creating a Netflix like exclusives model and the singles driven music industry, right now it’s unlikely that each record label will try to build their own digital music distribution channel. More importantly, the record labels don’t have the data Spotify does. If there are strong partnerships, profit sharing, and powerful tools to market your artists more effectively than traditional ad spend, why bother?

Partnering with a platform you are not fond of is not going to be easy for other record labels to stomach ($), but if you can’t beat ‘em: join ‘em. Especially if there’s enough partnership and data value to do so. (link)

Interesting reads

India is where it’s at for tech investment: Check out the longer take from last week. (link)

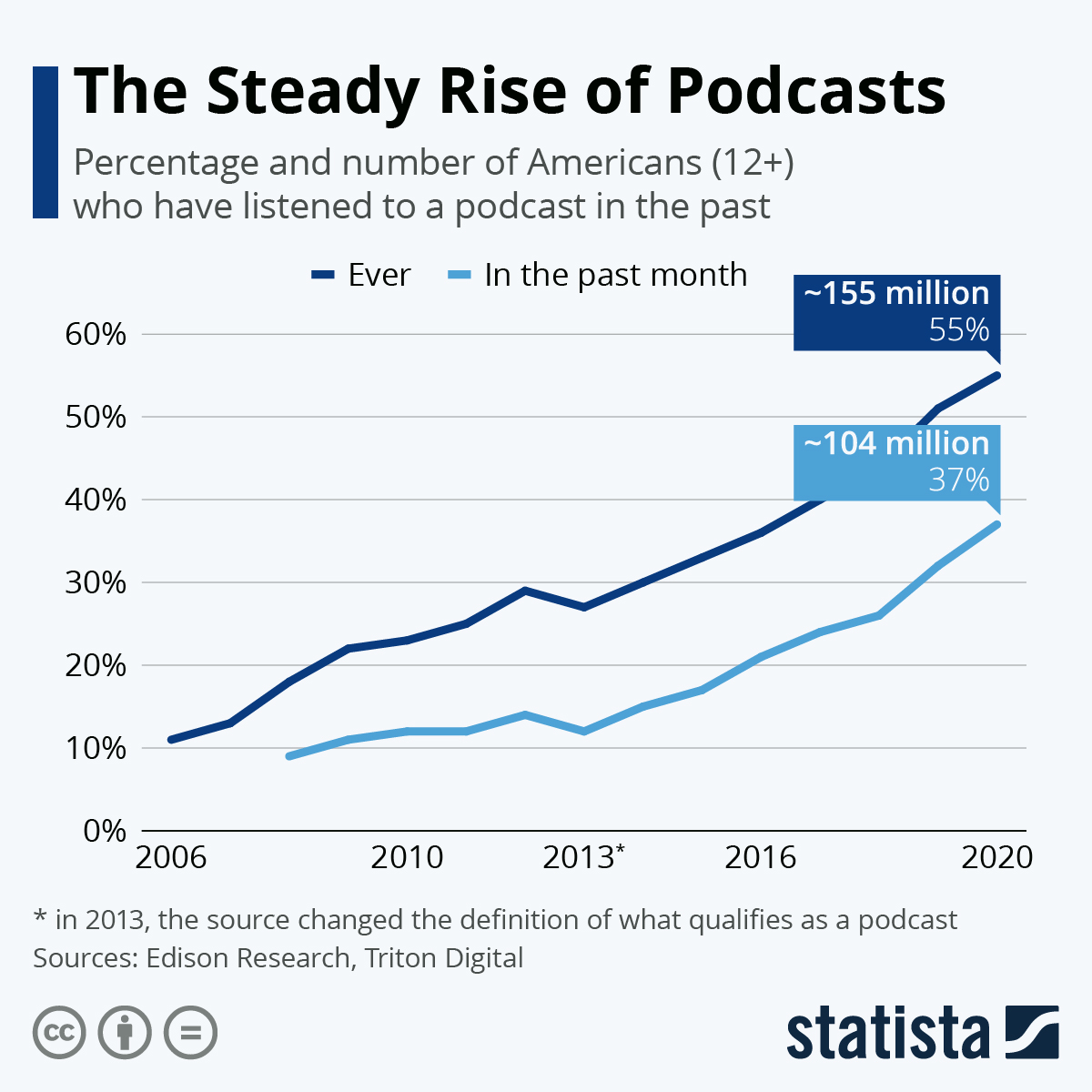

Podcasts continue to make waves after a couple of announcements this week: the NYT acquiring the production company behind Serial and Spotify’s new video podcasts. These come after the 2019 Spotify acquisition of Gimlet and earlier this year, the Joe Rogan's podcast. With the increase in podcast listeners to 37% of Americans listening in the last month (see below), companies are seeing market share opportunities through differentiation with exclusives and new content types that leverage pre-existing platforms.

Contrary to the points made above about the music industry, podcasts seem to be going in the same direction as the film and video streaming industry. My hunch is the content’s format. Podcasts are usually within a series, similar to television. Series take an investment from the user, which means they will keep coming back to the platform that has their show and, more importantly, listen to mid-roll ads. Spotify on the other hand realizes that music is more singles driven. With Apple seemingly neglecting their podcast app, one can only hope there’s one podcast winner… it’s hard to imagine another app with exclusive content.

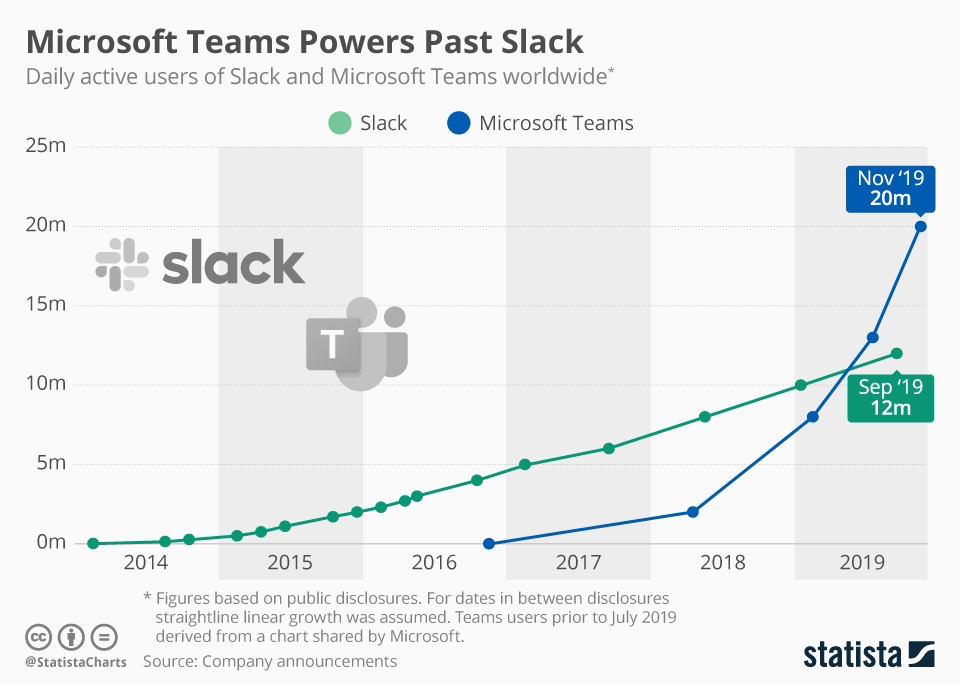

Slack it to the man: Slack filed an antitrust complaint this week against Microsoft concerning the bundling of Teams in it’s Office software. Frankly, this feels like a stretch for Slack here when it can’t make up its mind about Microsoft Office as a competitor (it is).

First, I want to point out that Microsoft Office is not a platform, but a suite of vertical productivity tools (or a “family of client software”, as wikipedia calls it) that you can pick and choose to use. If the main point of the claim is that that they are unfairly using Office dominance as a distribution mechanism, the example of Google’s latest business Google Chat offering bundled with G Suite, which looks awfully like Slack and Teams, should also be in the mix. In both cases, you can use Slack instead, just like you can use Google Sheets instead of Excel.

Second, using a distribution model within your suite of existing products for a product that augments and enhances each offering seems like strong competition, even if it does border on “tying”. The EU looks at a few aspects of antitrust here, but two are relevant here: does the add of Teams make Office users more efficient and is Teams a distinct product? If Microsoft can answer “yes” and “no” respectively, they should have an easier time deflecting by making messaging a feature rather than a product that improves the overall experience in Office.

Lastly, the optics here make Slack look a bit desperate. Reading the Stratechery daily update from Ben Thompson this week on Slack/MS, he says it well:

Perhaps the biggest takeaway, though, is a sense of bearishness about Slack: this is the sort of action you take when you feel deeply threatened, and the nature of this complaint makes it seem like Slack is feeling its addressable market constrict like a python as would-be customers standardize on Teams.

I couldn't agree more. To stay a viable business, and to productize a feature such as messaging, Slack needs to figure out how to partner with a strong competitor to Microsoft, pivot to new markets, or build/acquire other productivity products for its own unique offering. Meanwhile, they are losing their moat. (link $)

SPACs, the blank check public companies: a very new learning for me this week. Another path for companies to go public is to go through a SPAC, or a Special Purpose Acquisition Company. Very interesting model where a company IPOs with cash reserves rather than a product or business otherwise. This company then acquires/merges with private companies who want to skirt the time, regulation, and resources it takes to go public. They’re on the rise. (link $)

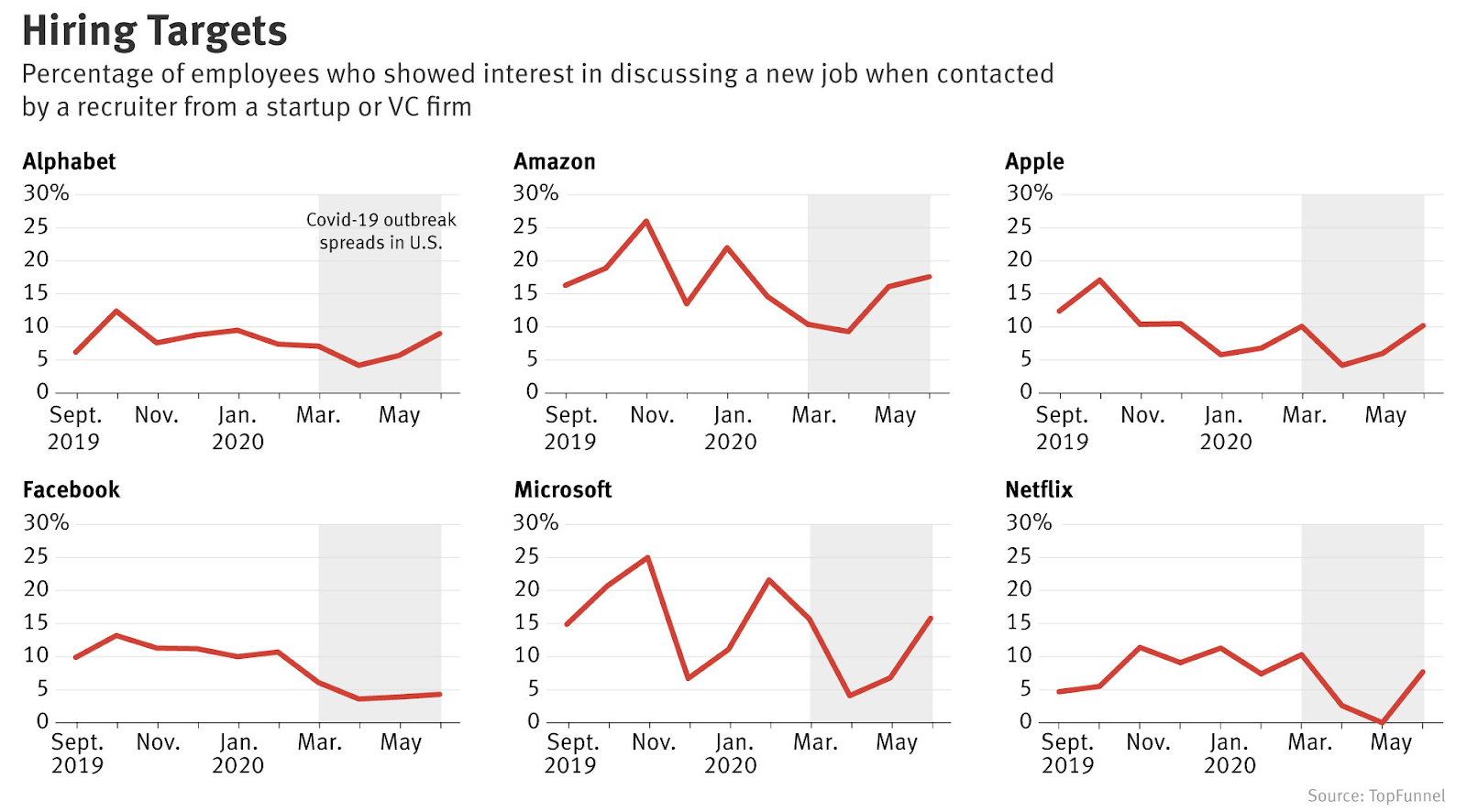

Startup confidence: The Information ($) put out an article looking at the percentage of employees who showed an interest in new jobs from startups or VCs in the face of potential layoffs. It is trending upwards, which can be seen as a corollary to increased confidence in the technology sector overall as tech workers become open to leaving comfortable, high-paying, and risk-averse jobs.

Hidden in this data is also an interesting look at employee satisfaction at the companies themselves, with Facebook having a lower absolute percentage both before and now in the pandemic even in the face of public scrutiny around politics, antitrust, and boycotts. I guess it’s hard to beat a remote working promise and a high paying salary. (link $)

Your personal shopper now owns their business: Dumpling helps shoppers for platforms like Instacart (the folks who buy goods you ordered on the app) create their own business. The claim is that this flips the gig economy on its head, but it feels like a subtle move to benefit shoppers. As competition heats up with an influx of shoppers on Dumpling, I am unsure the company can keep up with their Instacart competition and still tout the best pay for the shoppers while keeping consumer prices low. (link)

Even so, I believe this is the wrong conversation to be having when vertical integration and innovation with Central Fulfillment Centers from the likes of Walmart and Amazon will be tough to beat with any horizontal network of personal shoppers. What can differentiate the personal shoppers is the experience and the access to niche goods. Regardless, with CFCs, that market still exists for last mile logistics, which could be an easy pivot. (link $)

Bites

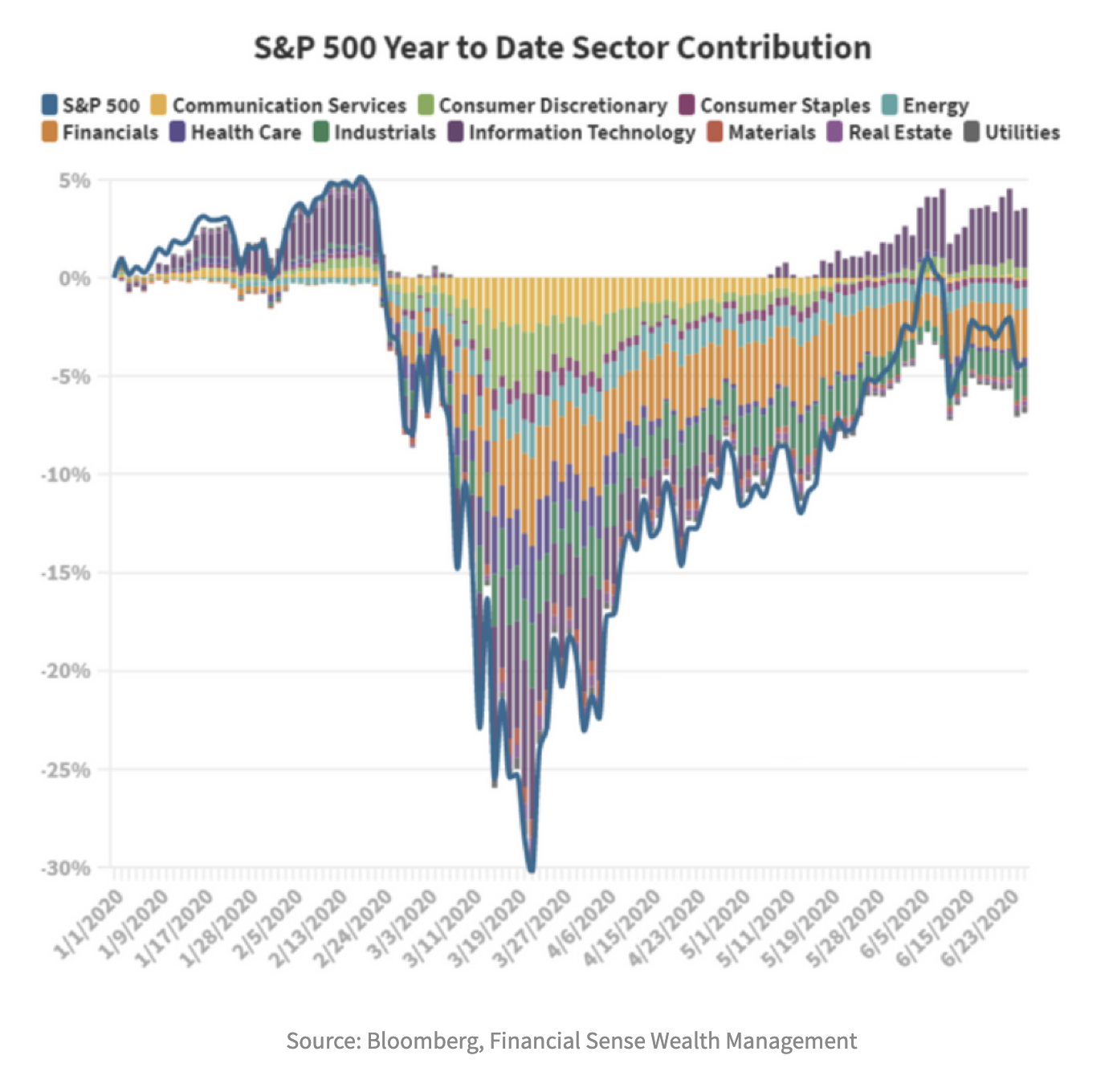

Increased investment in Tech: One chart that says it all (below) and the tech buyouts in the private market are also continuing. (link $)

Search-to-highlight: Google now highlights results directly in result’s page. (link)

Sprucing up that home gym: Prediction thread on the future of your at-home Equinox. (link)

Will you put a chip in your brain… for music? Sci-fi tech as a pet project for Elon (link)

Real world limits to artificial intelligence: electricity. (link $)

Breakdown on different subscription pricing models: how will you charge? (link)

We thought airline seat pricing was bad: but what if you want to go to Space? (link)

Snapchat… meditation? Smart play leveraging evergreen content. (link)

Follow-ups

Sports gambling to Robinhood: Last week one of the Techonomics readers brought up a great question as a follow-up on Robinhood v. the Institution:

I wonder how much money has gone from what used to go into sports gambling into the markets recently, and if that's responsible for any of the pumping we've been seeing in the markets.

Gambling in casinos is halted, gambling on sports is halted, so where are the gamblers going? As pointed out, a rational hypothesis is Robinhood. So, I looked into this, and couldn’t quite come up with the data needed to show that there is a direct correlation folks who used to gamble to those now investing (speculating?) on Robinhood. That being said, the newsletter Net Interest has a compelling argument. (link)

Lookback note at the Privacy Shield: As we look at the note from last week on the local internet, I made a claim that this would make it harder for small cap tech and startups looking to enter the market. On Monday of this past week, Ben Thompson dove a bit deeper in his Stratechery daily update:

Even once SCCs are knocked out, though, the solution for a company like Facebook is pretty obvious: simply build out data centers in the E.U. that import algorithms and machine learning models from the U.S., while doing all data processing locally. Sure, this is going to be more expensive and less effective than treating all Facebook data the same, but Facebook can afford it — as can Google, Microsoft, Amazon, Apple, etc. Things will be much more difficult for smaller sized companies; expect increased reliance on the big cloud providers to offer geographic data management as a service.

Small businesses and new entrants, meanwhile, will have the hardest time; being able to look at the entire Internet as an addressable market is a key factor in enabling increasingly specialized niche-focused business models, but that approach makes the most sense with a cost structure that itself takes advantage of technology. Duplicating functionality on different continents, though, is about geography and politics, and will certainly hurt new companies the most.

Again, this is going to be a ruling that actually increases the power and influence of larger tech conglomerates, even if it is correct for the EU to impart these restrictions on US companies due to the failure to treat EU (any?) data with care. As of this week, the invalidation of the Privacy Shield is already being put into practice without a grace period. (link)

Update to the India infiltration: In my outline of India investment in Jio networks last week, I missed a few reports on additional investment. The oil-turned-telecom company has additional investment from additional partners like Qualcomm, Intel, and Silverlake, bringing the total to 33% of the company for $20 Billion. Most importantly, there’s some really great additional points about Jio’s market share and potential monopolization here. (link)

Disclaimer (full)

Views expressed in “content” (including posts, podcasts, videos) linked to or created in this newsletter, website, posts, or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of any person, company, or entity I am affiliated with or each entities’ respective affiliates. The content is not directed to any investors or potential investors, and does not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.