Music’s profit journey

Physical to Digital to Streaming to Data

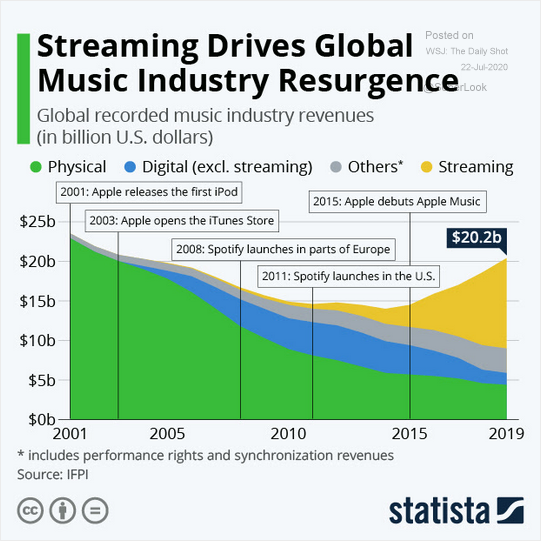

Napster was founded in 1999 and so began the digital transformation from physical to digital through piracy, and the coming loss of revenue until a low in 2014, just shy of $15B. With the creation of a platform that made it extremely easy (free?) to upload and download music, Napster was a catalyst for the digitization of music. With the addition of iTunes in 2003, we saw a large increase in the number of legal digital downloadsthat fell quickly with the introduction of streaming thanks to Spotify in 2008. Since 2011, we have seen a strong, consistent shift to streaming services.

There’s a lot to unpack here. Over the past ~20 years we have seen a few abrupt shifts in consuming music. Napster digitized music, but clearly didn’t think about legality. iTunes continued the trend and, thanks to Steve Jobs, began the monetization and broad distribution of digital music for the record industry, whether they liked it or not. As technology improved and the internet increased market penetration, streaming services came and changed the way we access, as opposed to own, digital music.

What’s interesting here is how quickly the digital downloads were upended by the complete takeover of the industry by music streaming services, led by Spotify. While it hasn’t been the most clean relationship between Spotify and the record labels, it shouldn’t be overlooked that Spotify and other streaming services have helped to bring the music industry back to its feet from that $15B low in 2014. Just look at the chart above. When piracy was destroying physical sales, even during the period of iTunes downloads, the new ability to stream an entire global catalog of music available to you made things much easier. At the price point of roughly $120/year, the effort and risk of downloading illegal music increased relative to the overall cost. While piracy will never go away, the music industry will battle against it. What better way to do so than to reduce friction, differentiate your offerings, and reach your listeners where they are? That’s what we see with music streaming.

This leads me to talk about the news this past week from Spotify and Universal Music Group who inked a deal to partner on the development of marketing tools. While this isn’t the first deal we have seen between Spotify and UMG, this announcement cannot be overstated. As discussed in the previous paragraph, Spotify and it’s record labels have not always had the best relationship, and rightfully so. It’s hard to navigate change, shift distribution strategy, and give a portion of profits to partners. The most important part here, however, is the mental shift of the music industry to own and leverage the new platform in which their music is being distributed and consumed: the computer in your pocket.

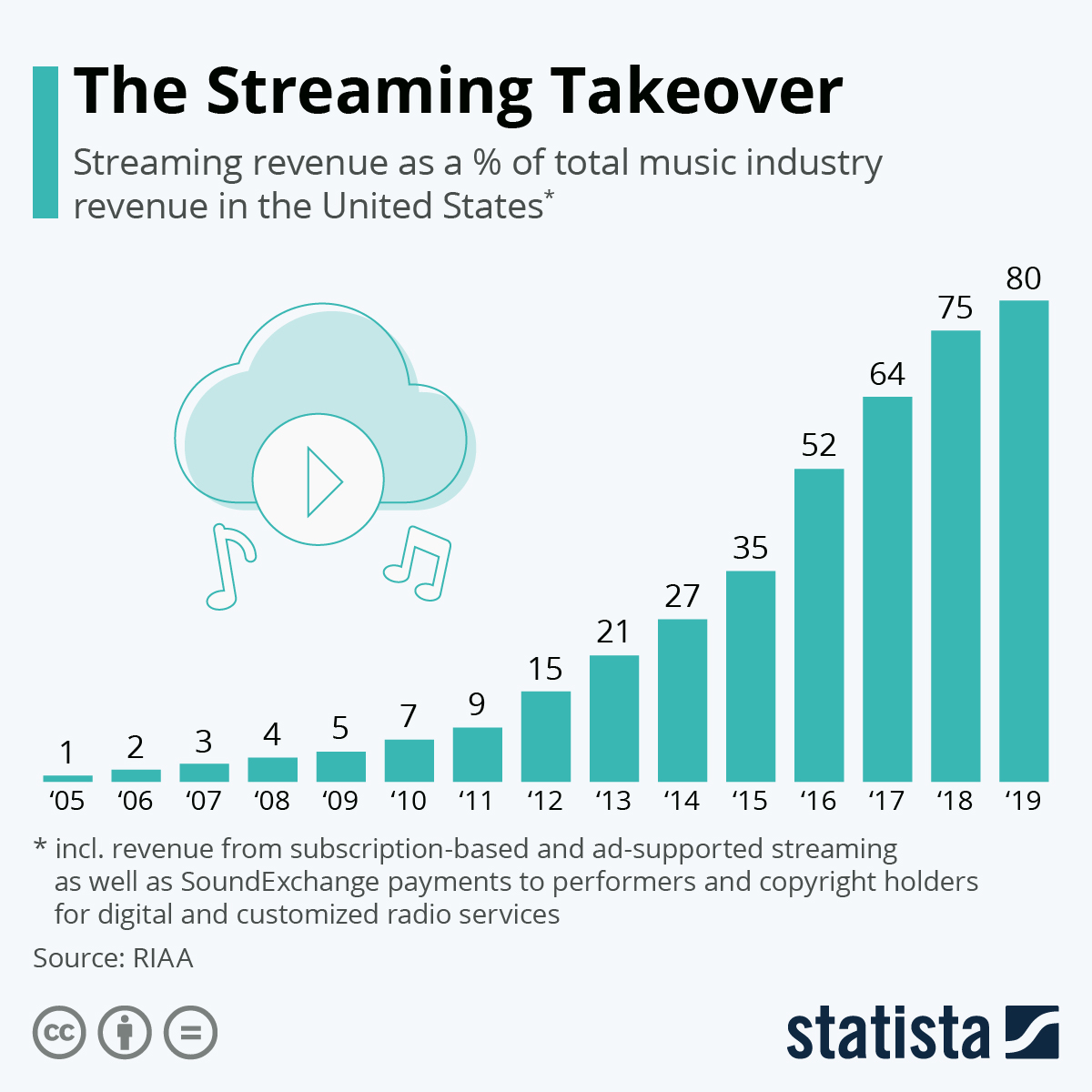

This huge shift in perceived value of a platform from one of shared profit and distribution to one of a potential marketing powerhouse is a smart one. It also rests on the overall percentage of profits for the music industry attributed to streaming we saw in the above visual and the below:

Technology continues to evolve industries, and kudos to Spotify for building a stellar consumer experience, gathering important industry data, and then selling that data back to the record labels as tools within a stronger platform. Without Spotify’s growth and market dominance in streaming, it’s unlikely that there would even be enough data and momentum to shift the mindset. Enabling marketing tools and leveraging the models of push notifications, emails, and whatever else Spotify and UMG can think up, coupled with the large and growing Spotify customer base, will continue to improve both parties’ revenues.

The evolution of the platform and content provider partnership here is not done, and I will be anxiously waiting to see how it shifts. I have always wondered if we will see an unbundling of sorts when it comes to each music label, similar to what we have seen in video streaming. However, given Spotify’s lack of creating a Netflix like exclusives model and the smaller form factor for audio content, right now it’s unlikely that each record label will try to build their own digital music distribution channel. If there are strong partnerships, profit sharing, and network effects from the dominant streaming platform, why bother?

The music industry and the labels have been through a lot over the last 20 years and things continue to evolve. While partnering with a platform you are not fond of is not going to be easy for other record labels to stomach ($), if you can’t beat ‘em, join ‘em, especially if there’s enough partnership value to do so. (link)