India is where it’s at for tech investment

Big Tech's move to invest in a growing market

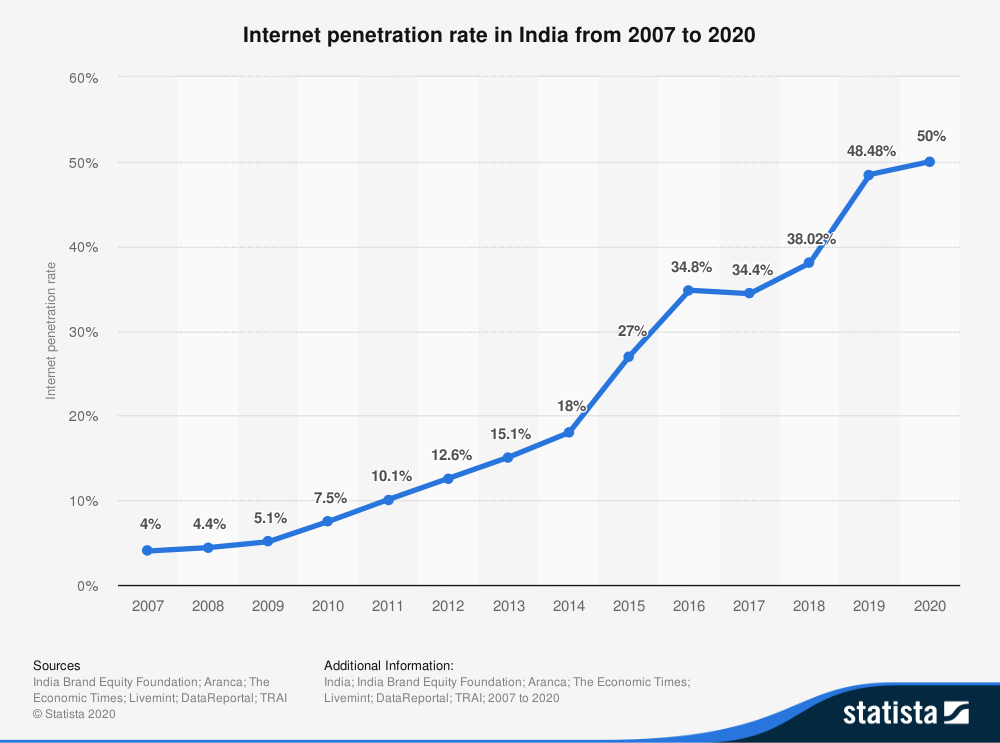

India tech investment and growth is exploding as more of the population gains access to the internet. With China and tech companies feuding, tech companies are looking at India’s low, but growing, internet penetration as an opportunity to gain global market share. Large tech is trying to capitalize: Google investing $10 billion, Facebook investing $5.7 billion in Jio, and Amazon investing $1 billion in digitization of small/medium sized companies. Walmart is even investing $1.2 billion in India’s e-commerce darling, Flipkart. Everyone wants a piece.

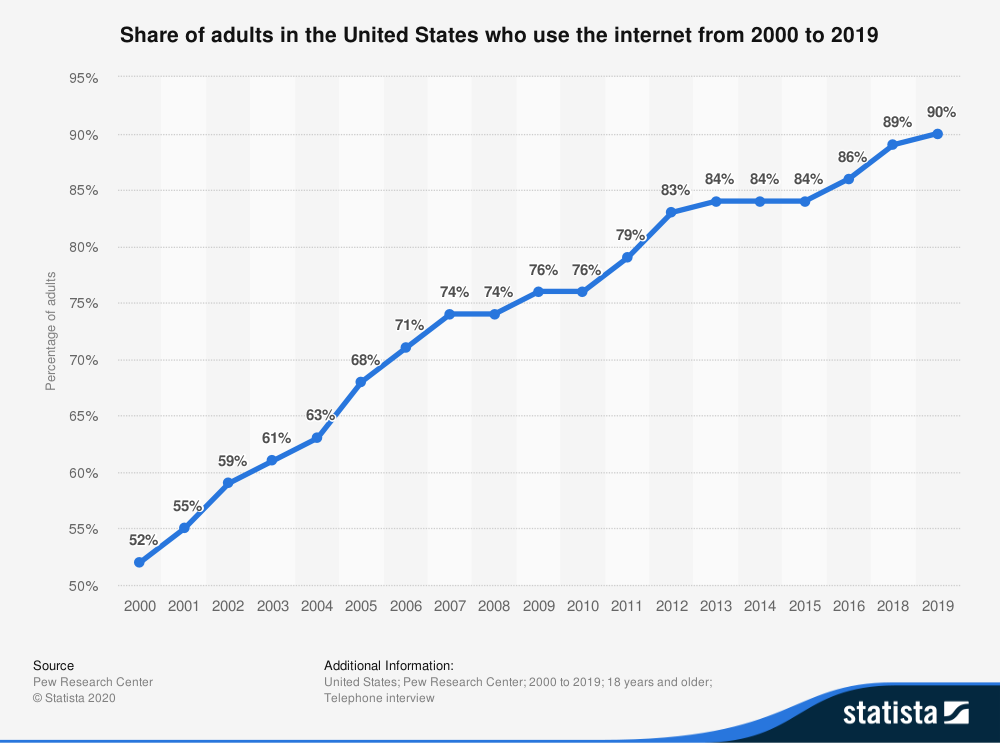

In fact, if we look at the USA, we can see there’s a 90% internet penetration rate with adults in 2019 which means that we have roughly 295.5 million people (90% of 328.2 million) using the internet. (Here’s the 2017 overall internet penetration as well, at just under 90%, to show that the adult population is representative.)

While in India, we see a 50% penetration… 20 years after the US hit that same number. While in absolute values, India internet usage is huge, around 690 million (50% of 1.38 billion total population), getting that next 690 million people online means lots of opportunity. More than double the opportunity in the US at full market penetration. Also, compare the shapes of the two graphs.

As countries become more saturated with internet usage, you start to see the Apple predicament: when you’ve hit diminishing returns or slower growth (in Apple’s case, the iPhone), you turn to new ways to leverage current assets in new way to grow (Apple Services). In this case, we see global expansion of new and existing products into new global markets for the big tech companies, and disruption from startups. The next question is, what’s the spend per user?