🍿 Thoughts on Quibi and Consumer Product

Why they missed out on what's most important for consumer tech products.

For those following tech news, specifically the streaming wars, it’s likely that you have heard that Quibi, the short-form mobile-first content streaming service that sits somewhere in the middle of Netflix, TikTok, and YouTube, is being shutdown after only being live for 6 months and taking on nearly $2 billion dollars of investment from tech VC, media, bank, and private equity investors ranging from JP Morgan to Lionsgate to Google. From that investment, Quibi plans to sell for parts and give back $350 million to initial investors ($). Not exactly the Cinderella story for a company with a once sky-high valuation with investor money to boot.

This is pretty enticing news. There have been a lot of articles, op-eds, and analysis done of this debacle of this tech and media unicorn that raised that large sum of money prior to launching anything. Lots of these opinions, including this analysis, are in retrospect. Being aware of that is important. Even so, the value of looking at what happened to Quibi through the lens of consumer software, venture capital, and what it takes to be successful in a market is helpful to remind us how to assess future hype and potential investments. Let’s dive in.

What makes a consumer product successful?

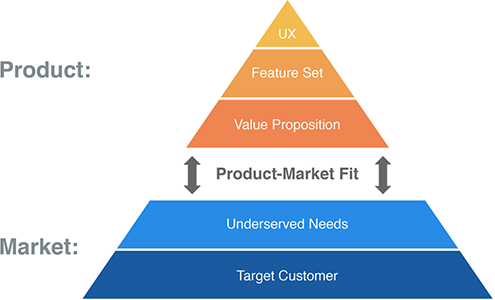

When you look at the consumer tech market, you’ll see entire app stores filled with applications and services that cater to different needs from photo editing to social media, each preying on novelty at first in the hopes of becoming ubiquitous. These applications try to set themselves apart from the crowd with solid branding and a novel approach to a problem while retaining consumers for the long-term using strategies like network effects. In the world of consumer content and streaming, there are a few more important concepts than the flywheel of great content and these said network effects. Underlying the quest for ubiquity, though, is product-market fit.

To quote Marc Andreesen, product-market fit is the only thing that matters for startups. For startups entering a market with real customers, understanding that their product has not only solved a need for said customers, but that those customers are actually willing to pay more and evangelize the product, is the pivotal to early success. There are many other aspects to running a new startup that can cost the life of the startup, but finding product-market fit is the foundation for which the company can build on.

How do you achieve product-market fit? Well, you need to build and release a product to the world, test with customers, and iterate (or sometimes even pivot completely). The important part here, if you buy into product-market fit, is that you need to release the product. That should go without saying. It’s table stakes to gather data from your customers on what is or is not working. Without that data, you fly blind.

Now, there are other ways to get that data without releasing a product to the market and it depends on what type of product you are building and for what market. One of those ways would be to look at an existing product with product-market fit for clues. If you are putting out a new product into a new market to solve a unique customer need that the world hasn’t seen before, then your chances of understanding your customers and their needs is going to be much harder than if you are releasing a product that is similar to other products in a market. That information is a proxy that you may have an easier time finding your fit.

A quintessential example of this is, luckily, in the streaming world. Think about Netflix. Their market is three-sided: viewers (you and me), TV and film studios, and themselves. They found product-market fit back in the day when they rented DVDs through the mail instead of needing to go to Blockbuster. Then, famously, they iterated into the streaming world. Customers were willing to pay a monthly fee for their subscription and talk to their friends about all of the shows they were watching on Netflix, enticing others to join. The underserved need was access to content and the value proposition of Netflix was that your content can be available anywhere for a low cost.

This model was so successful, and the product-market fit was so strong, that it created an entire industry. Now there are a plethora of different streaming giants to choose from, and they all differentiate on unique content with a similar format. Disney+ has Disney movies, Hulu specializes in TV, Amazon Prime Video essentially copied Netflix with the added bonus of being able to purchase content that isn’t available for streaming, and Apple TV+ aggregates content from them all. The pattern here is clear: exclusive syndicate deals with TV and Film studios while also creating your own exclusive content can help differentiate you enough to leverage Netflix’s proven product-market fit.

Quibi’s approach

If we take product-market fit as the most important thing for a startup, Quibi unfortunately wasn’t able to achieve it, yet raised $2 billion dollars from prolific investors before the product launched to the market. This signals obvious investor sentiment that the idea of Quibi alone as it relates to the streaming and consumer technology market was enough to overcome the need to verify and test the product within the market. Quibi didn’t need to test in the market, because the idea and the market were rationalized to fit.

In hindsight, that may seem obvious, and we can’t be exactly sure what other reasoning each of the investors had to pour money into Quibi, but there are some pretty solid guesses.

The first is that social and streaming companies can be very lucrative, just look at Netflix and TikTok. The second is that sometimes your belief in a founder and previous success, you can be blind to the lack of product-market fit, and people believed in Jeffrey’s track record as a media exec. The third is that investor psychology and FOMO are real, and if many investors are investing, then you may feel the need… take a look at TikTok. The last is that the success of other applications or services in an adjacent market can lead to biases on how a new product will perform, or in other words, how it will achieve product-market fit.

Reading that last point, you can rightfully point out that just above I made the point that you can look for data and information in existing markets and products to give you signal on how your product will be taken up by the market. There is a small nuance with Quibi though: Quibi didn’t really know which market or products to look at.

What do I mean by this? Well, many people look at Quibi as a streaming service while Quibi themselves believe that their competitors are (were?) Instagram, YouTube, and TikTok. The founder of Quibi, Jeffrey Katzenberg, once stated “We’re competing against free,” which encompassed all of the free social and streaming apps on your phone. However, that wasn’t really the case. Quibi found its product, its pricing, and it’s content in a bermuda triangle, taking on the form of Netflix, TikTok, and YouTube without any of the strengths of each.

A little bit of this and a little bit of that

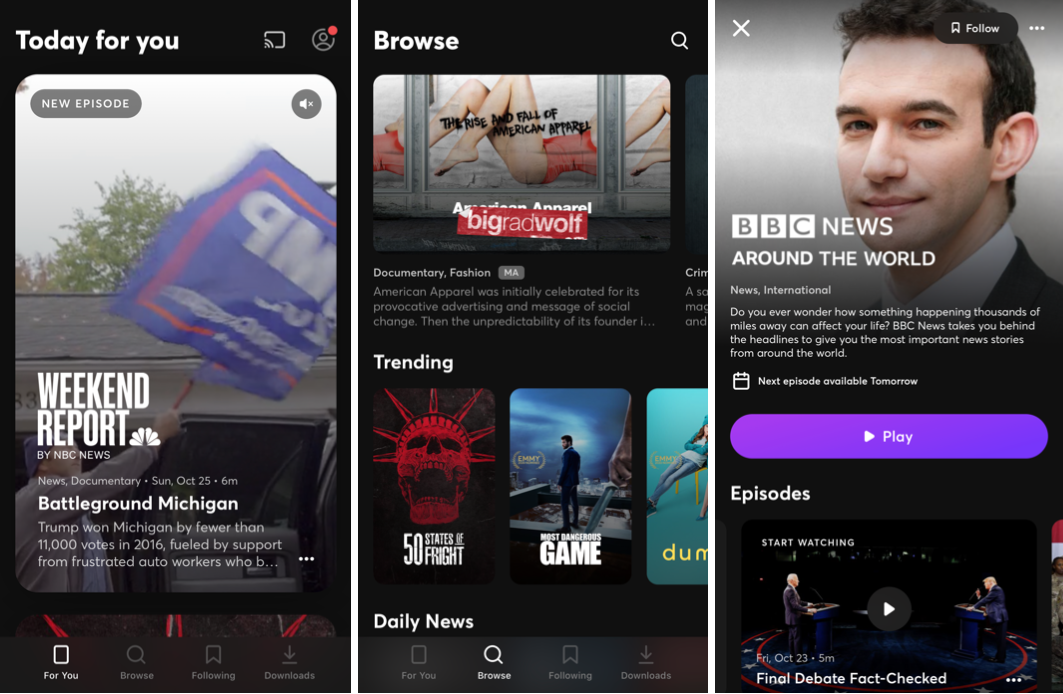

Let’s first look at Quibi’s product with a few screenshots.

What’s the first thing you notice? For me, this looks like Netflix, Apple TV+, Amazon Prime Video, and Disney plus. The content is beautifully laid out, I understand that there is some trending content, I have small snippets to entice me to tap, and it looks like a streaming competitor that is looking to differentiate with unique content, but supposedly Quibi’s not competing in the streaming market? I find that hard to believe, but, in any case, they seemed to be replicating the success of Netflix.

Continuing through, there is also a lack of network effects. There’s the typical “share” button, but there’s no way for me to generate content, either a video myself or a comment to another Quibi user. These are foundational aspects of any social product like YouTube, TikTok, or Instagram. If Quibi was competing against these companies, their app certainly doesn’t show it. The only thing Quibi had in common was, like TikTok and Instagram, the mobile-only approach to their video experience. There was no sign of user-generated content anywhere.

Getting into the content itself, it’s short-form and around 10 minutes an episode. Now we are at the idea Quibi was built on, that short-form content could be produced as well as a Netflix series while being digestible for the short time you have between the subway and your house. There’s obvious issues here that the COVID-19 economy exploited, for sure, but outside of that, this is truly a brand-new combination of studio-generated content in short-form. Studio-generated content that is extremely expensive to create, and where Quibi was planning (and did) pay $100,000 per minute of content, or $6 million per hour. Quite the departure from the quoted $500-$5,000 per hour for short-form YouTube created content. YouTube content that not many folks pay for, and frankly ridiculous.

Luckily, I didn’t have to pay for this content yet as I investigated, but the pricing strategy was also interesting. At $5/month (ad-supported) and $8/month (no ads), you could keep Quibi shows flowing through your mobile device. This pricing strategy seems not so bad until you look at the long-form content on Hulu for a price of $6/month (ad-supported) or $12/month (no ads) that works across all devices. If your competitors are the streaming giants, this is only slightly cheaper, but if you are competing with TikTok and Instagram, this is not how you win.

With the product, content, and pricing, it’s clear that Quibi sits in the middle, but doesn’t differentiate itself enough through a single strength. Short-form content was it, but it didn’t take, shown by the 90% of users that left after free trials ended. Quibi, then, is a typical streaming app with exclusive, expensive Netflix studio style content that’s shorter and only available on Mobile (until recently) for a fee that closely resembles the streaming industry.

Back to basics

If we boil down that last statement above, it seems like Quibi would be anything but a solid investment. It took a massive amount of up-front capital to test an old product (Netflix) with new content (studio short-form) on only one platform (mobile).

The idea that Quibi leaned heavily on a content format from the adjacent market of user-generated content (TikTok, YouTube, and Instagram), increased the quality through huge spend, and leveraged the distribution mechanism from the streaming industry, isn’t necessarily a bad one, but that’s not the point. The fact that they created a huge catalog of content and spent $1 billion to do so without testing the combination of the product, content, and pricing in the market, is.

Up-front investment is always needed to test out an idea, but the amount of said investment varies. If we look at Netflix in the early days, they figured out product-market fit by using the tools available to them to send existing DVDs through the mail. Pretty cheap and easy to do. Even moving to streaming is generally cheap, which they did to syndicate content before spending loads on their own Studio content. We can also look at YouTube who built one platform that content creators can use to create the content that makes YouTube great, effectively giving them free content and a flywheel network effect to grow the business.

Those two companies found product-market fit through testing. They figured out how to get their product to market, get feedback, and iterate to make sure they had customers who would evangelize the product and, most importantly, pay. Quibi did the opposite. They front-loaded content creation without testing it in combination with the product itself. While content creation can be a chicken-and-egg problem, pumping hundreds of millions of dollars into a new content format without verifying its market appeal, or supplementing a small amount of the new format with other content types, didn’t leave any room for failure.

It may be obvious now, in hindsight, that what Quibi could have done here was test their content to see if they had product-market fit before investing so heavily in a content format. There are many ways to do this, like licensing a couple shows to another streaming provider or creating short-form content for a user-generated platform like YouTube or Instagram, but Quibi went for the whole kit and caboodle without knowing their recipe was a success.

This is a time to understand that the basics of startups and technology companies are still fundamental to their success. Testing an idea, iterating, and finding your product-market fit early will make things much easier as you head to a market and point your investment dollars in a certain direction. Taking large bets are important, but so is the data-backed confidence that your idea will pay-off.

Quibi didn’t have product-market fit because they were trying to create a new market by way of a new, expensive content format the world hadn’t seen. It's hard to create a market when you haven’t tested the product and even more expensive to create studio quality content that no one will watch. Quibi, and their investors, learned the hard way that the most important thing is product-market fit, and that getting there doesn’t have to be so expensive. Unfortunately for Quibi, they’ll remain in their self-created bermuda triangle of adjacent markets, and fortunately for us, we can learn from their mistakes.