🎄 Techonomics #21: A Holiday Surprise, 2020 Wrapped, IPO Exuberance, and Antitrust

Happy Holidays.

Final 2020 Edition

I’m Jake and welcome to the final 2020 edition of Techonomics! We are on our 21st edition and now have 3,561 subscribers who get this newsletter delivered directly to their inbox weekly. Thank you for the amazing year of growth. What a year it’s been.

In the spirit of the new year, if you’ve found value from this free newsletter, can you help share it? That would really help us spread the word. Thanks again for reading and being part of the community. Looking forward to keeping it up in 2021.

Happy holidays and I will see you next year! 🎁

— Jake

🍔 Techonomics Podcast #1: Airbnb, DoorDash, and What Makes a Technology Company

This week we have something special to share. Arun and I will be putting out a Techonomics podcast every other week, and we are starting with only paid subscribers. If you want a sneak peek, please subscribe and click the play button. We’d love your feedback.

Each podcast will be 30 minutes and dive into the same type of content you see coming through Techonomics writing, with a healthy conversation exploring those topics in more detail and having some fun along the way.

This week we are talking about the Airbnb and DoorDash IPOs. We also touch on what it means to be a technology company. Take a listen. (link)

Visual(s) of the week

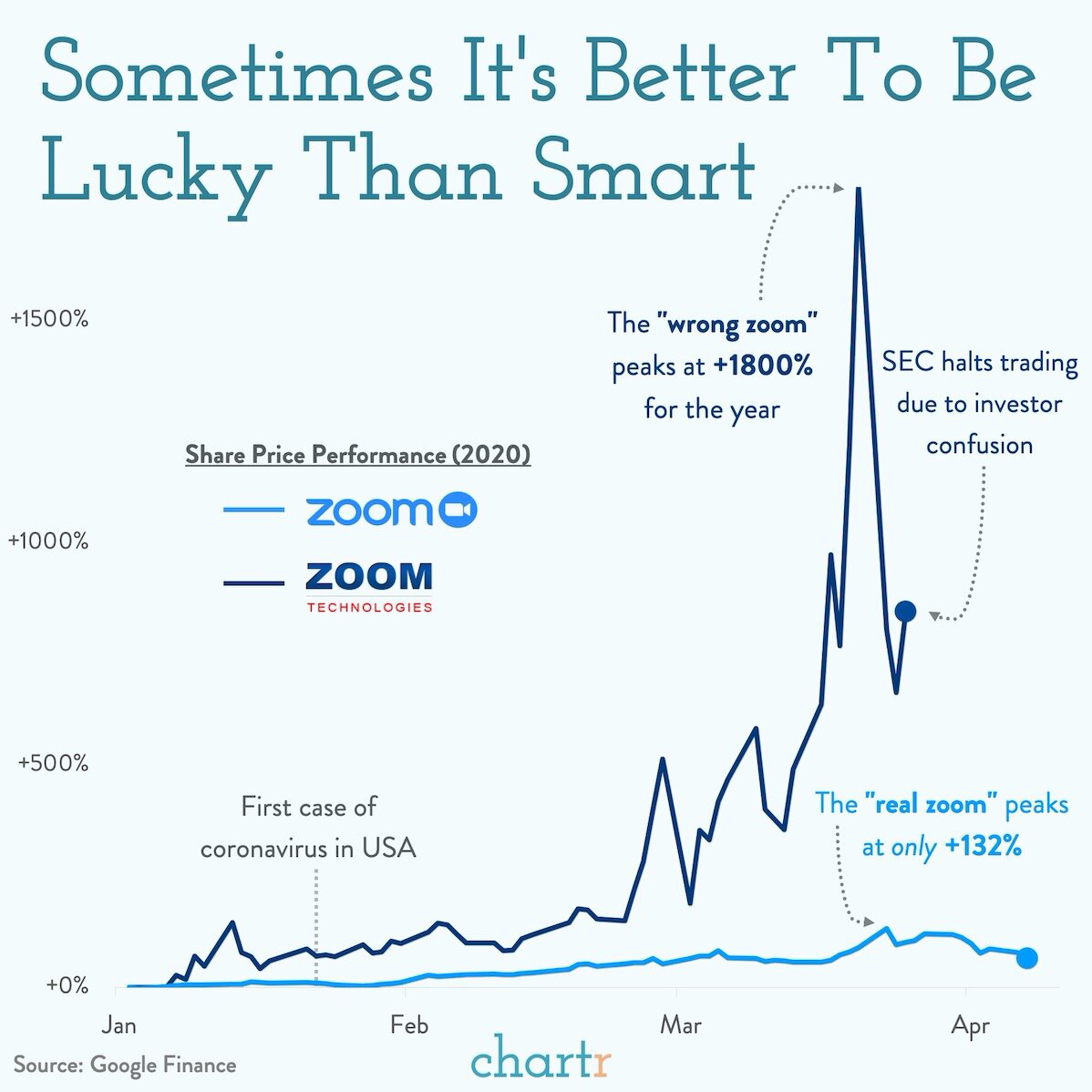

📊 2020 in charts: 2020 may not have been the year we were hoping for. It was wrought with hardship across the board, led by the pandemic. It’s always important to reflect and no better time than the holiday season to do so. To help, chartr put together 25 data-filled charts from the past year for us to go through. While some aren’t all the most joyful, the vaccine is being distributed as we speak and things are looking up. Humankind coming together to develop and distribute a vaccine in record time is an amazing feat. It will take us a while, but we will get there. In the meantime I included my favorite chart of the bunch for a little bit of a laugh. 😂 (link)

Interesting reads

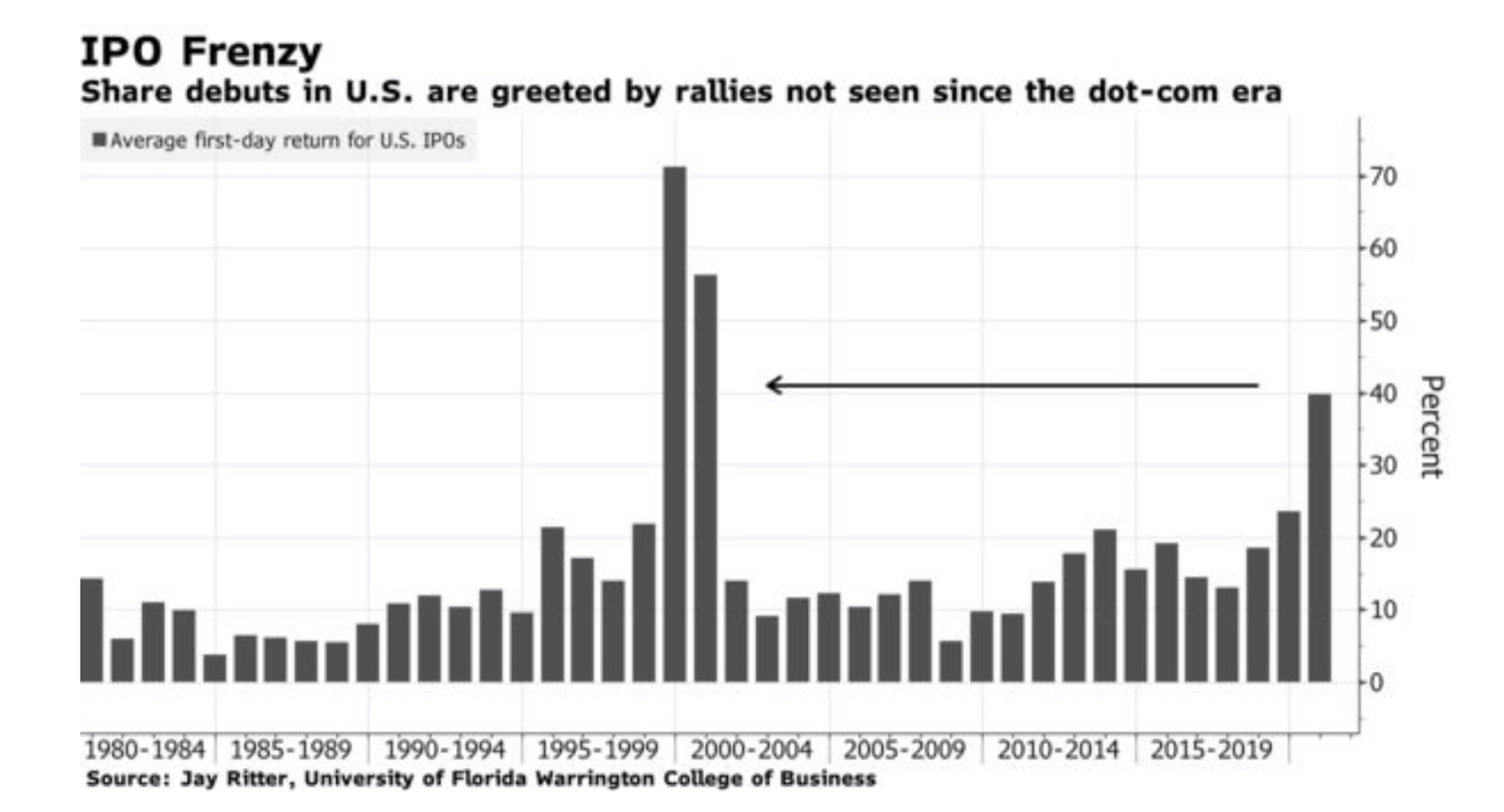

✋ IPOs-a-plenty: But some of them are delayed. This year the IPO market has been hot, with a large number of technology companies with COVID tailwinds going public. They aren’t doing so bad at an average of a 40% rally. For some companies it’s a no-brainer to try and get to the public markets as soon as possible to lock in a larger raise, but for others think it’s not such a good idea. If you have a great business that isn’t just on the COVID tailwinds, it can also leave a lot on the table in the initial offering where the price of the IPO deviates from the price in the market on day 1. With IPO pops like we have seen, that increase and delta between the initial offering before it hits the public market is good news for those investors and the employees, but it does leave a lot on the table for the company who could have priced the shares higher. This is likely why Roblox and Affirm have delayed until 2021. While patience may be the winner for those two, for others like Poshmark ($), it may be the right call to get on the exchanges ASAP. (link)

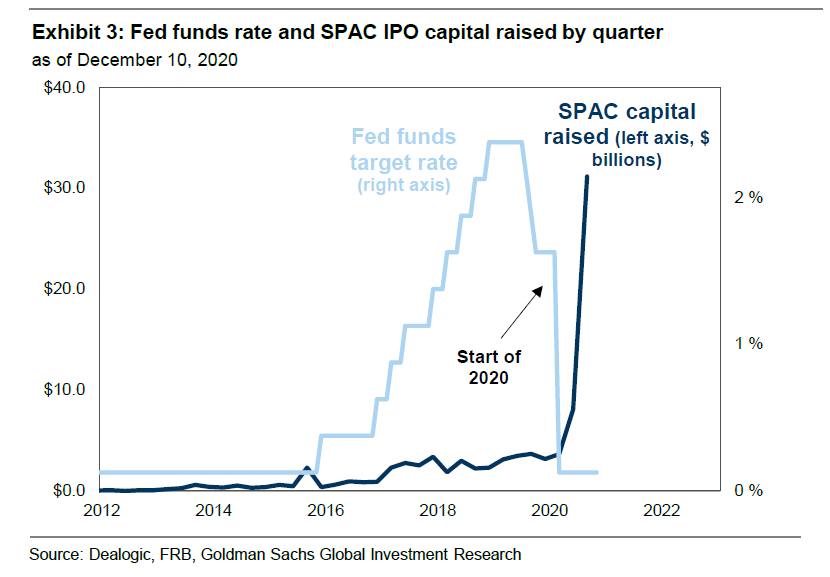

📈 Irrational Exuberance: was coined by Alan Greenspan back in the late 90’s before the dot-com bubble and refers to positive investor sentiment creating a flywheel with higher and higher asset prices inflating the market. While I typically don’t love looking back at history as canon, I do think there’s some merit to the argument that the current numbers in our market are unprecedented due to the pandemic response of low interest rates, low bond yields, and corporate bond purchasing that, in addition to the democratization of financial tools like Robinhood, is causing the stock market, Bitcoin, real estate, and other asset classes to inflate to forward-looking revenue multiples that we haven’t seen before. I don’t have a prediction here because, well, predictions are dangerous and wrong in many scenarios when it comes to a market that is mainly driven by human psychology. It’s a good time to watch, learn, and make sure positions make sense. (link)

🍎 Apple’s even more vertical: We know that as companies grow, margins and control become more attainable and important to sustained growth. In Apple’s case, that means its chipset with the new M1 chips as it rids itself of Intel and focuses on its own vertical integration. They aren’t stopping there though, and are looking at building their own graphics cards and their own modem. Apple’s always been a heavy hitter and a company that makes up a large percentage of profits from players like AMD and Qualcomm, but when Apple ventures out on their own, it’s painful for said companies. Just ask Intel. (link)

🖥 Microsoft stealing a playbook: Apple isn’t the only one using the vertical strategy of designing their own chips, Microsoft is reportedly doing the same by designing ARM based chips for their servers and Surface devices. Designing your own chip means more control and a tighter integration between software and hardware. That typically creates a better user experience, whether that be compute power and reduced power consumption or a more efficient application runtime. This is another blow to Intel who has provided the x86 instruction set for Microsoft’s chips for decades. It’s also a nod to the ARM instruction set for cloud compute and the genius of NVIDIA’s acquisition of Arm Holdings. This is exactly the continuation of design and fabrication fragmentation that we talked about in 🏭 What's in a chip? Breaking down the Semiconductor Industry. (link)

🏋️♂️ AI is not SaaS: I have some experience working in the consumer world using AI to train models for things like feed relevance scoring (i.e. what shows up in your feed), but I didn’t know much about AI companies and their business models in terms of model maintenance and retraining costs in addition to their cloud compute and storage bills from AWS, GCP, and Azure. This article lays it out well, specifically looking at three areas of how AI is different from the SaaS models we see from companies like Snowflake: gross margins, scaling challenges, and weaker defense moats. The information is useful when looking at market valuations like that of C3.ai. (link)

😰 Google’s in hot water: Antitrust is heating up for Google. While the DOJ antitrust case is suggested to start in 2023, there were a flurry of lawsuits brought to Google by various state coalitions last week. There are now 3 lawsuits against Google’s monopolistic power in three related areas: purchasing rights to search engine defaults, advertising business, and vertical search. For those that can’t keep up, including me, here’s a good explainer of all of the suits.

While I do believe that Google has monopolistic power in a number of areas and is the clear target out of all of Big Tech for such allegations, it can’t be overstated what benefit this company has had to the broader tech ecosystem and overall market through its R&D and free products. The arguments are interesting then because they balance customer choice and satisfaction vs businesses and anticompetitive behavior. With the consumer internet, there’s always a choice, and most people choose Google.

I am imagining the outcome of these cases will be smaller than we are making it out to be. What will change? I am assuming: user pop-ups for default search engines, some restrictions on the type of Google results they can return in product, and tools for the vertical search space. (link)

📧 Same for Facebook: Facebook is also being dragged into the antitrust circle, but things are looking a bit more dire for them than they are for Google. The difference in these cases is intent and motive. Facebook has outright, in many emails, stated that they needed to purchase WhatsApp and Instagram in order to prevent competition. That’s not easily argued against. What is tougher in this case though is hindsight bias and what to do if Facebook is convicted of anti-competition.

Can you look back at the acquisitions on WhatsApp and Instagram and say for sure that they would be where they are today without Facebook’s help? No. Can you provide evidence that Facebook wanted to neutralize them as a threat? Yes. Which brings us to the last question: what should we do?

Breaking up those companies from Facebook might not be the right thing to do, but learning about tech industry trends, partnering with technology companies more closely, and using that information to put more scrutiny on acquisitions will be a step in the right direction. Let’s not forget that Snap, TikTok, Twitter, and the like are still social networks that compete with Facebook. (link)

Bites

🏠 The Airbnbs: A note about the Airbnb founders, persistence, and what set them apart. (link)

🏢 WFH/W: Google’s eyeing a hybrid work-from-home model. Can’t say I am surprised. (link)

🤑 Free Money: Ubisoft announced it would give $10 to buy Ubisoft games if you play Hyper Scape. It’s an interesting model that’s been tried before, but much easier to swallow when you have 0 marginal costs.(link)

🔌 What do you think about Tesla? Folks are split on the price of the stock. (link)

{} Embedded finance: Why the API layer for money movement is ripe. (link $)

💓Gathering Biometrics: Amazon’s new health and fitness tracker is being questioned. (link)

⌨️ Hack: A big story this week was the SolarWinds hack. It was a doozy and good reminder that we need to take cybersecurity seriously at the top level. (link $)

Follow-ups

☁️ Cloud consolidation: Twitter announced that it was moving its timeline infrastructure from its data centers to AWS. Not only is that a huge move for cloud computing, getting a large company like Twitter to ditch its own infrastructure, but the migration also includes using Amazon’s Gravitron ARM-based server CPU. This is another blow to Intel in the cloud. We will likely see both patterns continue, growing the ARM instruction set server-side and increasing big cloud provider profits. (link)

📉Are SPACs here to stay? There was a lot of raising into the SPAC realm this year. (link)

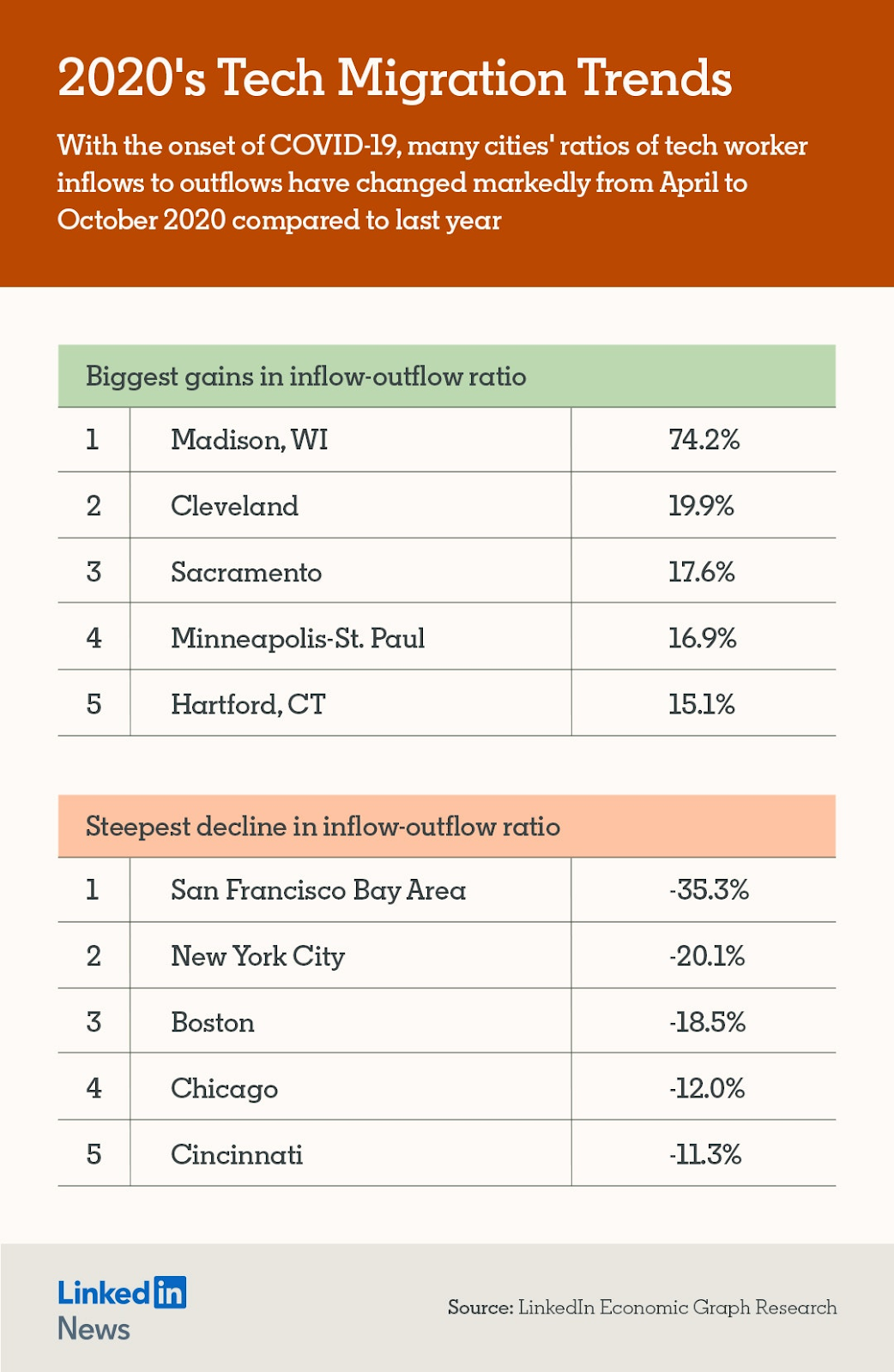

🏝 Remote working: Is everyone moving to Austin and Miami? The Twittersphere has had prominent VCs discussing their next steps, but just because one or two folks are moving to those cities it doesn’t mean everyone is. There was some really interesting data that has come out from LinkedIn’s economic graph that the Big Technology newsletter dove into this week. There were a few surprises to me. (link)

My essays

If you missed them above, check out essays from previous weeks. Heads up, some of them are for paid subscribers.

- 💬 Slackforce

- 📈 Ubiquity and Bitcoin's Return

- 💳 Visa & Plaid: The DOJ Applying Learning from Tech

- 🍿 Thoughts on Quibi and Consumer Product

- 🏭 What's in a chip? Breaking down the Semiconductor Industry

- 👩⚖️ Section 230, the Senate, and Understanding the Internet

- 🍪 Upending the Internet’s Free Business Model

- 💸 Productization & Platforms

- More…

See you next year!

Disclaimer (full)

Views expressed in “content” (including posts, podcasts, videos) linked to or created in this newsletter, website, posts, or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of any person, company, or entity I am affiliated with or each entities’ respective affiliates. The content is not directed to any investors or potential investors, and does not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.