📈 Techonomics #18: Ubiquity and Bitcoin's Return, Shorting Robinhood Herds, and the Upcoming Tech IPOs

Belief in Bitcoin, shorting the Robinhood herd, and a look at Tech IPOs.

Welcome to Techonomics

I’m Jake and welcome to our 18th week of technology industry analysis. We now have 2,946 subscribers who get this newsletter delivered directly to their inbox weekly. Thank you for all of the support and please share to someone you think could enjoy a read.

This week

I am excited about the longer take this week on Bitcoin’s return. It takes a high level overview of Bitcoin, cryptocurrency, and why it holds value. It might not be what you think.

First time readers

Techonomics is a weekly newsletter exploring the intersection of technology, business, and the economy from an engineer’s point of view. We will deep-dive into tech industry news, including niche news that may fly under the radar. Content and commentary to help make sense of the technology sector.

Also, take a dive into a few of my previous essays to get a sense of what you’ll find week after week:

- 💳 Visa & Plaid: The DOJ Applying Learning from Tech

- 🍿 Thoughts on Quibi and Consumer Product

- 🏭 What's in a chip? Breaking down the Semiconductor Industry

- 👩⚖️ Section 230, the Senate, and Understanding the Internet

Enjoy!

— Jake

One longer take

📈 Ubiquity and Bitcoin's Return

A refresher on Bitcoin, its value, and how we got here.

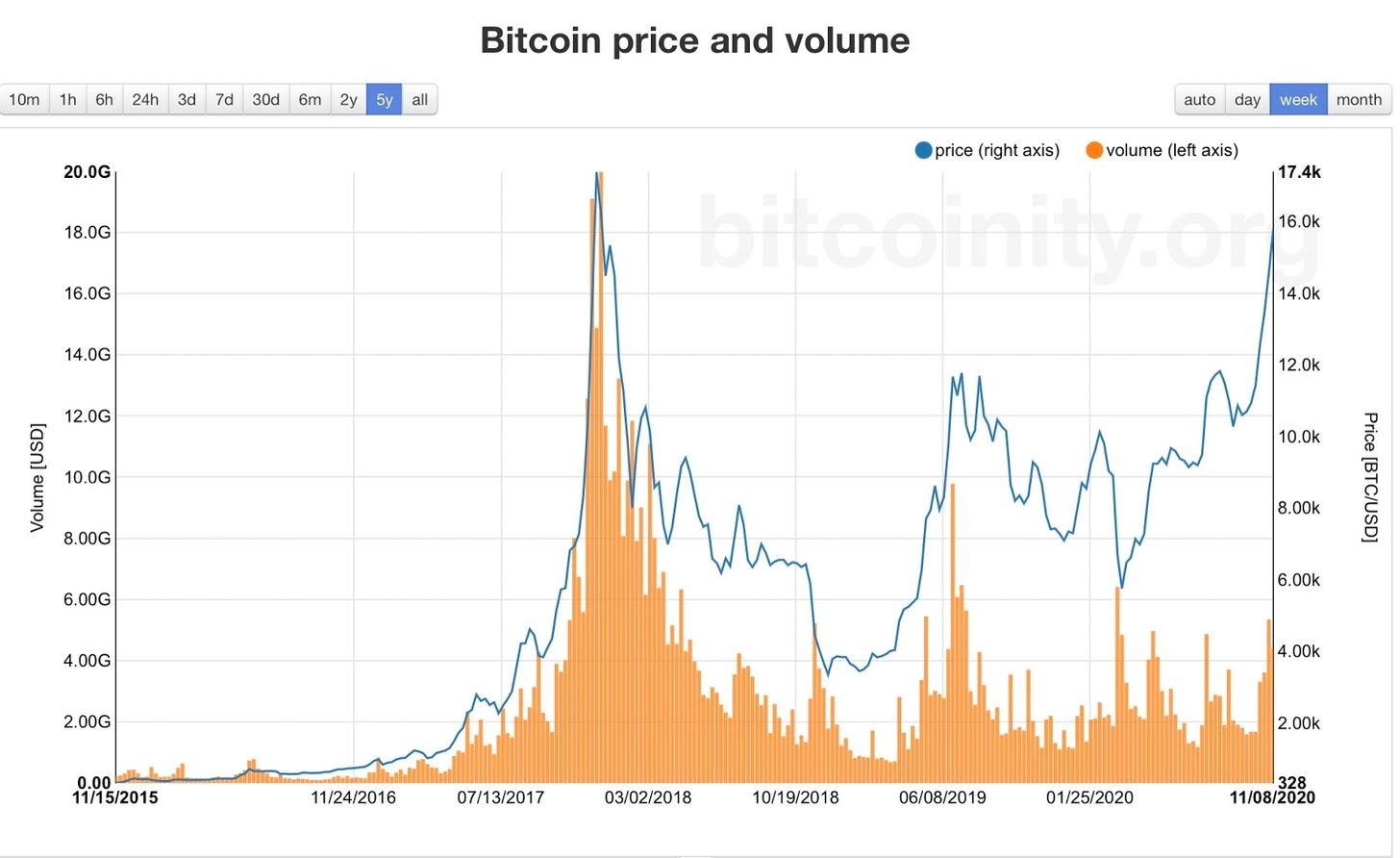

You may have seen that the price of Bitcoin is climbing back to its Christmas 2017 high of ~$20k. At the time I am writing this piece Bitcoin is sitting at $18,552.33 per coin [0], up roughly 60% over the past 3 months and a whopping 155% up over the past year. Not bad.

What’s interesting to me here is not necessarily that asset prices are fluctuating and inflating — we’ve been seeing that across the stock market since the initial COVID drop in March — but that the cryptocurrency asset class and its increase has flown a bit under the radar from what used to be surrounded by hype. I resigned, as many have, to the fact that said hype from 2017 had worn off and crypto lost its steam as a speculative play in a get-rich-quick scheme. In a world with democratized financial tools like Robinhood, we’ve seen a huge influx of traders into the stock market that’s been widely reported on, but we haven’t seen the same when it comes to the trading volume with Bitcoin or other cryptocurrency exchanges.

In fact, when comparing the trading volume to price over the past 5 years, we can see that there is an evident correlation between each during the mania in 2017, but from 2018 on we see that the trading volumes are consistently low when compared to price.

That’s curious and there are a few reasons why we are seeing a pricing comeback, but before we dive into that, let’s get a quick reminder of Bitcoin — cryptocurrency — fundamentals so we can explain it to our relatives at Thanksgiving.

Visual of the week

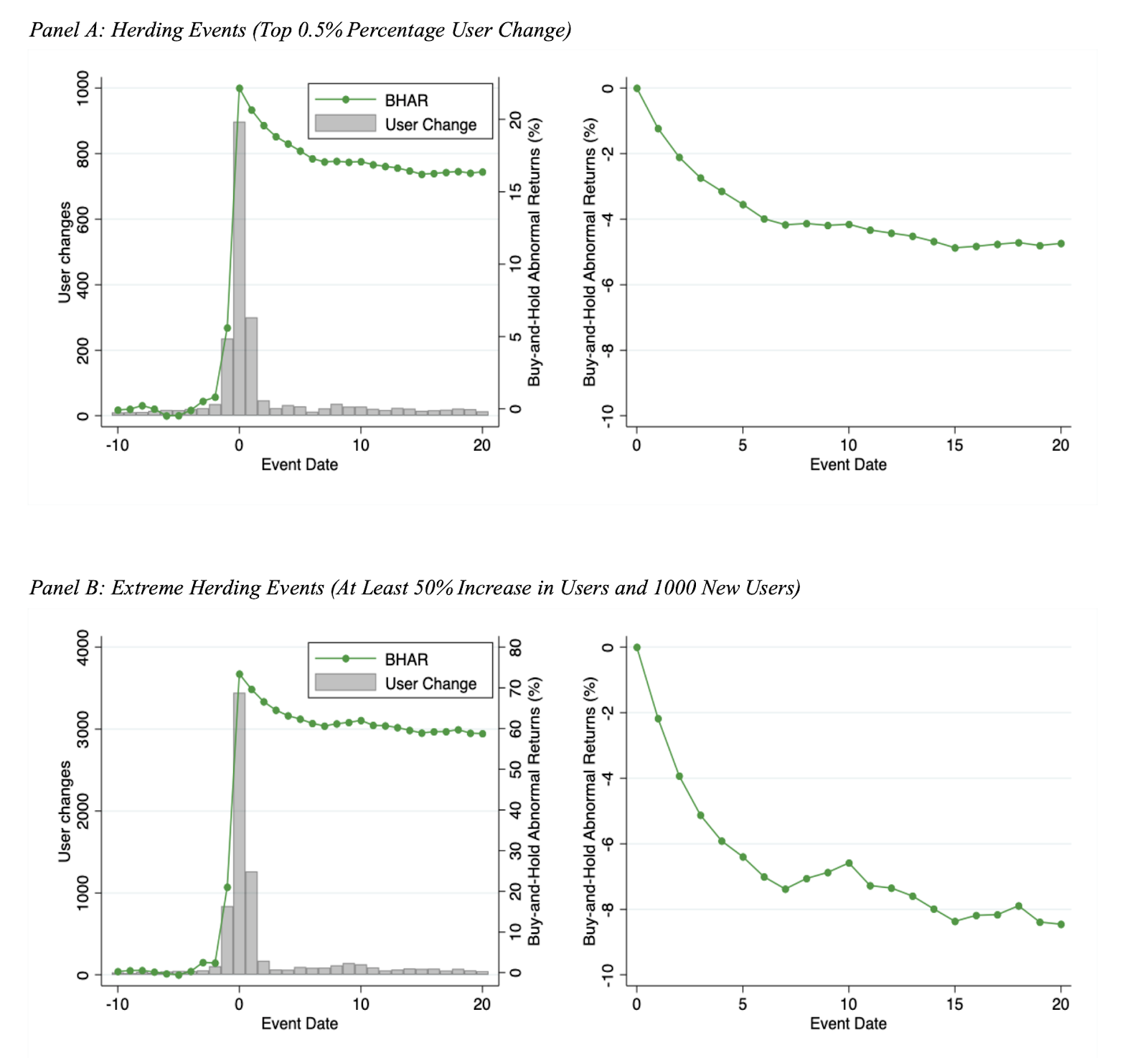

📊 The Robinhood Short: A recent study looked at herding events where Robinhood traders pile into momentum stocks. It found that:

“Average five-day abnormal returns are -3% (-6%) for the top stocks purchased each day (more extreme herding) by Robinhood users.”

While I don’t love putting away fundamentals and gaming of the market, that means that you might end up with a better chance of a short if you follow the herd. (link)

Interesting reads

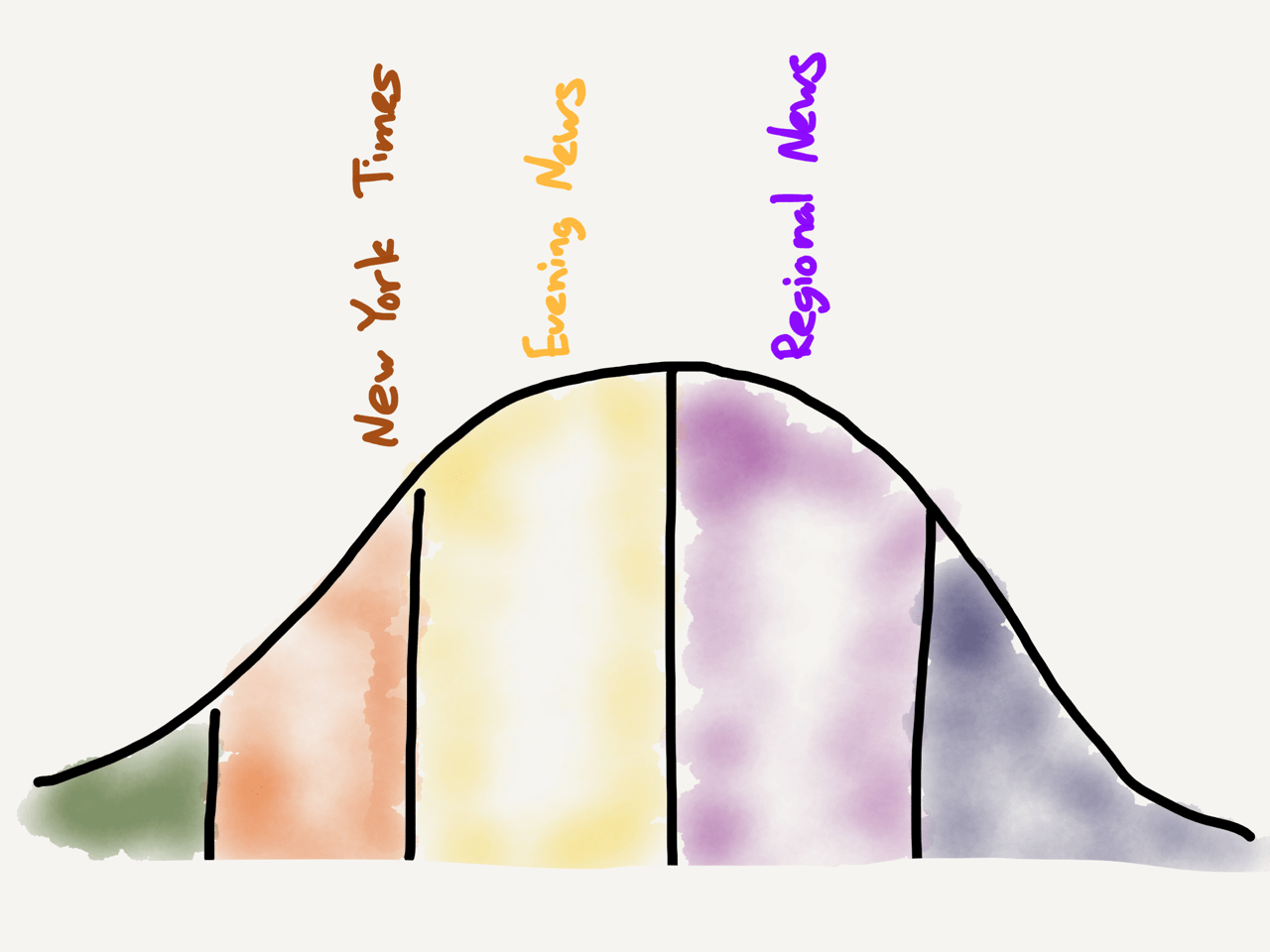

💭 Idea Adoption: Ben Thompson is back this week with a great piece on the idea adoption curve and how subscription models in news can cause a leftward trend through incentives to be more bold in prediction rather than simply reporting. I hadn’t thought about this use of the technology adoption curve and crossing the chasm, but it makes sense. How does that fit into the revenue models of traditional news outlets who rely on ads? (link)

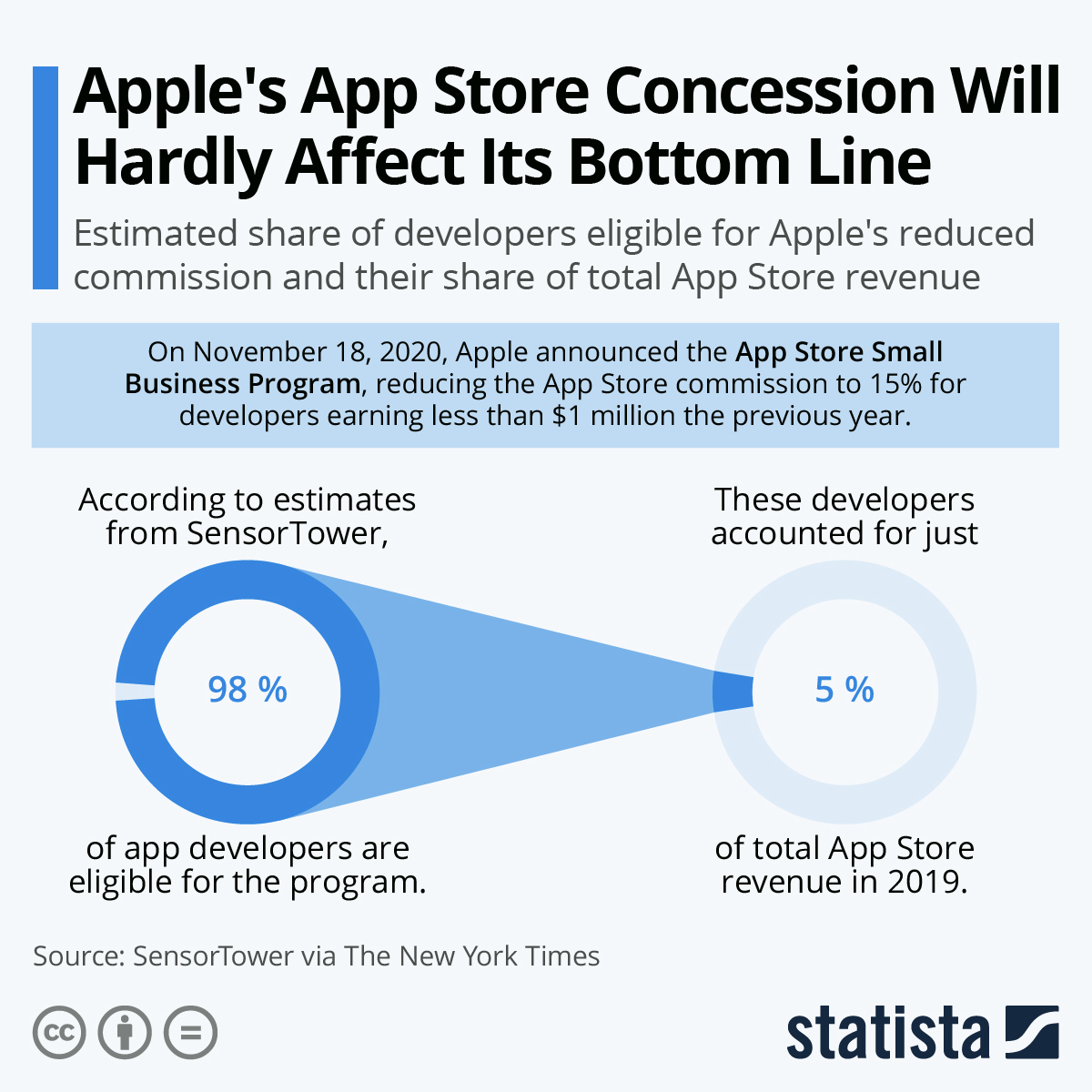

🍎 Apple’s small, but meaningful concession: Apple announced that it will reduce App Store commissions for developers earning less than $1 million the previous year to 15%. This sounds amazing, but the fact that it only makes up for 5% of the App Store revenue in 2019 is even more so. In the wake of antitrust cases and legal pressure over reducing their App Store rake, it’s no shock they are making moves here. Some say this is a small percentage with no meaningful impact, but if you flip it around and look at all of the developers gaining from this, it does paint a rather nice picture if you can stomach the profit from the top 2% of developers like Epic Games. (link)

💸 Once novel, now unfunded: There were two announcements this week that didn’t catch me by surprise, but that were a showing of novel ideas not coming to life. This happens all of the time in technology, but with COVID and tech companies moving back to the main line of business, it can be disheartening. The first was the layoffs in Amazon’s drone delivery division and the second was Google’s shutdown of the Loon project (wifi balloons). I can’t wait to see more moonshots like the hyperloop get up and running -- and hopefully finished. (link $, link $)

🌏 The new kids on the bloc: Really interesting article on the new RCEP trading bloc in Southeast Asia and how it shows China’s power and influence in global trade after the US pulled out of the TPP (Trans-Pacific Partnership) in early 2017. The sheer magnitude of the trading alliance is something to consider, but also the US’s absence. How this changes with the new Biden administration will be important to watch as the US is reducing its Global power through the flurry of trade sanctions and foreign policy over the past 4 years. (link)

↕️ Vertical Integration Diff: The Information put out a piece on the difference in the business strategy of Apple and Amazon. Mainly that Apple is vertically integrated as a closed circuit while Amazon is vertically integrated as an open circuit, many times productizing its efforts like AWS or their new trucking fleet. The point is that Amazon may be at risk more than Apple when it comes to antitrust even though Apple is more of a closed system. I agree and think that it’s actually more in Apple’s power to play in its world than try and open it up to competitors. Allowing Lenovo to use the M1 isn’t the same as Amazon productizing a supporting, but non-differentiating aspect of it’s business. (link $)

🤑 IPO Season (again): Airbnb, DoorDash, Roblox, Wish, Affirm, and even Robinhood are all anticipated upcoming Tech IPOs. There is a lot of data to sift through with each of these companies, but the most interesting part is that all of these companies were impacted by COVID differently, mostly for the better. It’s been a wild year watching all of the IPOs, with the average tech IPO actually down from it’s initial price. Do these companies have fundamentals and staying power post-COVID, or are they trying to ride the wave? My gut: hospitality is shifting, video games are sticky, food delivery is hard, online shopping is too competitive, and finance isn’t going anywhere. (link $)

Bites

🍔 Now THAT is demand: In-N-Out Burger opened in Colorado. Would you wait 14 hours? (link)

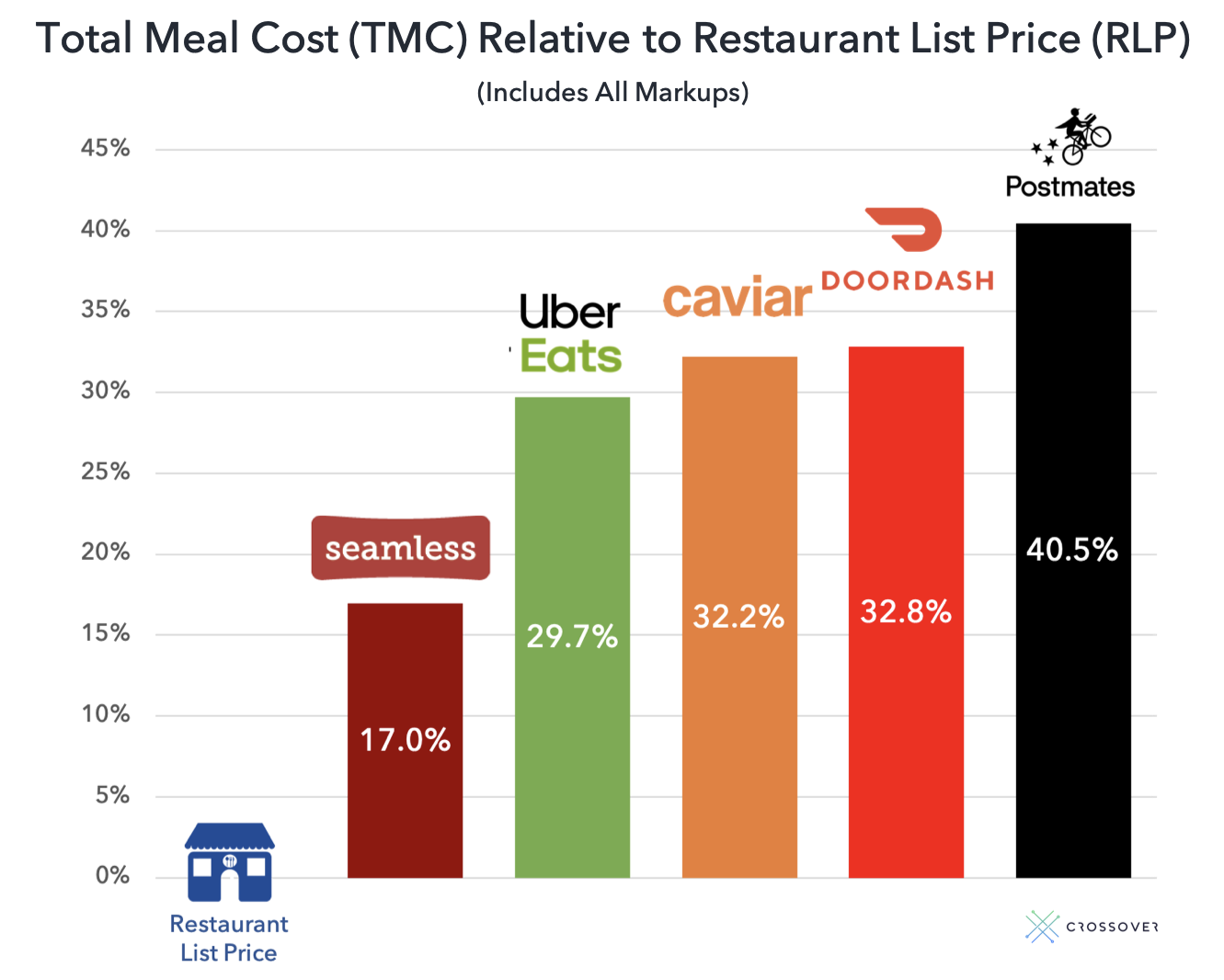

🍟 The true cost of delivery: may be higher than the price appears. (link)

🎨 Painting at work: a young employee was fired for making TikTok videos of paint mixing at Sherwin-Williams… sounds like a marketing play, not grounds for firing. The videos are cool. (link)

🕴 Breath of creativity: COVID is hard on many, but some are rising above by turning their skills into their first businesses. (link $)

🎧 Shazam’s list: A list of the most Shazamed songs of all time that makes me wonder if it’s because they’re catchy or because no one can remember the artist. Perhaps both. (link)

Follow-ups

🔐 Apple’s security response: Last week we looked at an article diving into security and tracking issues with Apple’s MacOS. This week they responded, and I am glad they did. With software, there are always going to be vulnerabilities, and companies do the best they can to ensure they are fixed. Sometimes it is foul play. I am of the mind that there are many ways that we give up our data everyday and we need to limit our exposure, so if Apple can actually follow up on encrypting this data, then we can move onto the next issue. (link)

⌨️ Typo: Thanks to those of you who pointed out that I misused Shopify in place of Spotify when talking about Section 230 last week. First off, this means I am lucky enough to have readers like you. Secondly, I corrected this, but unfortunately my typo will live forever in your inbox. 🙂

My essays

If you missed them above, check out essays from previous weeks:

- 💳 Visa & Plaid: The DOJ Applying Learning from Tech

- 🍿 Thoughts on Quibi and Consumer Product

- 🏭 What's in a chip? Breaking down the Semiconductor Industry

- 👩⚖️ Section 230, the Senate, and Understanding the Internet

- 🍪 Upending the Internet’s Free Business Model

- 💸 Productization & Platforms

- 🇦🇺 Australia vs the Aggregators

- 📊 Software IPOs and S-1s: playing with numbers

- 📡 Cable Companies and the Innovator’s Dilemma: Round 2

- 🙉 Tread not-so lightly: Antitrust & Corporate Venture Capital

- 🛍 CFCs, urban warehouses, and the last mile

- 🤖 Big Tech and Antitrust: The Capitalism Paradox

- 🎵 The Music Industry's Profit Journey

See you next week!

Disclaimer (full)

Views expressed in “content” (including posts, podcasts, videos) linked to or created in this newsletter, website, posts, or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of any person, company, or entity I am affiliated with or each entities’ respective affiliates. The content is not directed to any investors or potential investors, and does not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.