💸 Productization & Platforms

How Amazon, Netflix, and Other Companies Leverage Stored Value

I have been thinking a lot about business strategy lately. Through reading technology news week-to-week, there is a pattern that’s increasing my understanding of the impact and value of technology companies. Impact and value that might not be top-of-mind based on what that company is known for.

If we were to look at technology companies like Amazon or Netflix, we could say that they are dominant in their respective industries of e-commerce and content streaming, and that would be true. A large percentage of the company value is derived from the main product offerings. However, there’s more than meets the eye.

As companies scale and become dominant in their industries, they want to grow sales, reduce margins, and increase profits. There are a few ways to do this like increasing market share, increasing per user spend, or reducing operational costs by vertically integrating operations. This will make any company more valuable.

But as companies start to see diminishing returns on investment in their main product line, have vertically integrated to improve margins, or are simply looking for future growth, they need to diversify outside of their main product or service offering.

What happens at that point? Well, the company starts to look for addressable markets, opportunities, and areas of internal stored value. Stored value as second product offerings and revenue streams to be unlocked for the masses through productization [0], many times as platforms.

Amazon’s Money Maker(s)

The quintessential example of this is the e-commerce giant Amazon, where you can purchase nearly anything on the planet and have it delivered to you in a few days or even hours. That includes tech gadgets, groceries, and over-the-counter medicine. But Amazon didn’t always have every product known to man or drones carrying your packages.

When Amazon first started out in 1994, it sold books online, and frankly, had a site that looked like the mid 90’s.

As Amazon continued to grow into the behemoth we know today, the number of listed products grew and grew, as did sales volume and revenue. To foster growth, they adopted the flywheel concept [1] internally and started running projects to spur and support adjacent projects that can leverage internally stored value.

Third-party sellers

In 2000 Amazon first opened up its doors to third-party marketplace sellers. Amazon allowed these sellers to list and sell their products on Amazon for a cut of the sale price. This increased the number of available products on Amazon, improving the overall experience, and positioning Amazon the go-to place for online shopping. This move unlocked the stored value of Amazon’s marketplace that already served their own products, and they did so at low marginal cost, simply augmenting Amazon to allow sellers to list.

This was the creation of Amazon as a platform, not just an online store.

Then Amazon upped the ante. In 2006, they identified an additional area of stored value in their warehouse, packing, and shipping logistics. As the company grew to a large scale and had orders and packages processed in their owned warehouses across the globe, they realized they could offer these warehouse logistics to the same third-party sellers they opened up Amazon Marketplace up to six years prior… for a fee.

This increased the strength of the marketplace platform, reduced friction, and made it even easier for sellers to list, sell, and now ship their products all over the world. It increased Amazon’s revenue and the value of Amazon as a platform.

Stored value in the sky

In that same year, Amazon.com and it’s marketplace platform were scaling quickly. It so happened that there was another area of stored value awaiting productization.

Since Amazon was running as a dot-com, e-commerce marketplace, their home was the internet. In order to run on the internet, you need to have a website or a mobile app. In order to run a website or mobile app, you need servers and databases. A lot of them. So Amazon reorganized its technology infrastructure into separate, decoupled pieces that when pieced together, made up Amazon.com.

That decoupled infrastructure became AWS, starting with S3, Amazon’s first productized datastore. So started the shift to cloud computing before cloud computing was a thing [2]. AWS is the second large platform propping up Amazon’s value.

Platform value

If I hadn’t brought you through some of the large platform products, you may have thought that Amazon’s own e-commerce sales would have made up the majority of their revenue. With COVID-19 shopping and Amazon expanding globally, that’s not a bad guess.

But, if we look at Ben Evan’s recent post on Amazon [3], we are reminded of where Amazon’s value truly lies: their platforms.

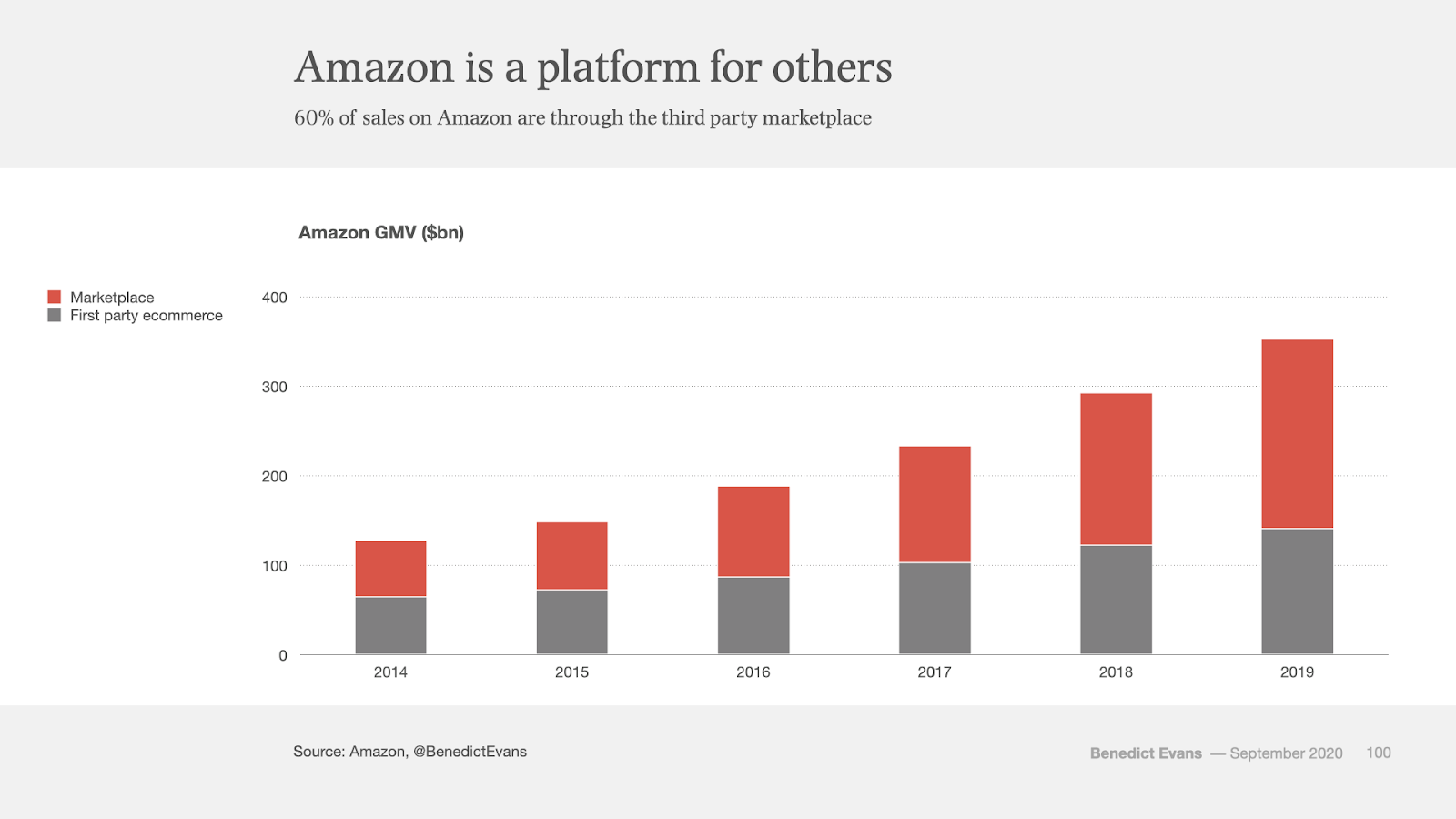

Let’s look first at the Marketplace revenue:

60% of Amazon’s sales come from third-party sellers, not Amazon’s own product listings. Amazon is essentially a customer of its own marketplace platform. Well, the biggest customer… but still. Amazon successfully noticed the stored value of their company as not just an e-commerce seller, but as an e-commerce platform, enabling growth and revenue from the success of others. Smart.

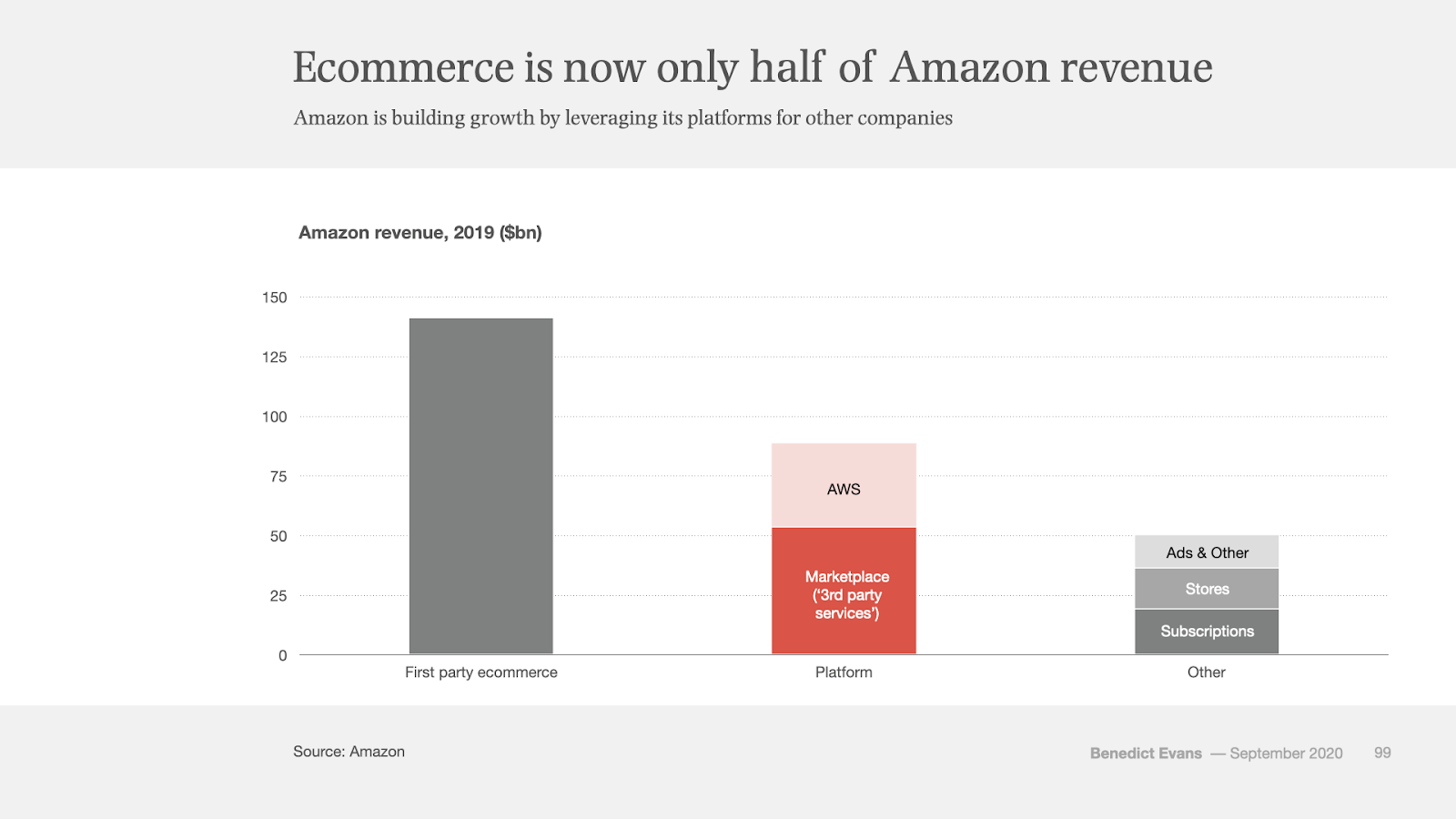

What about AWS? Well, when you add up AWS revenue with marketplace revenue:

Marketplace and AWS are now the dominant pillars of Amazon’s business. Pretty wild.

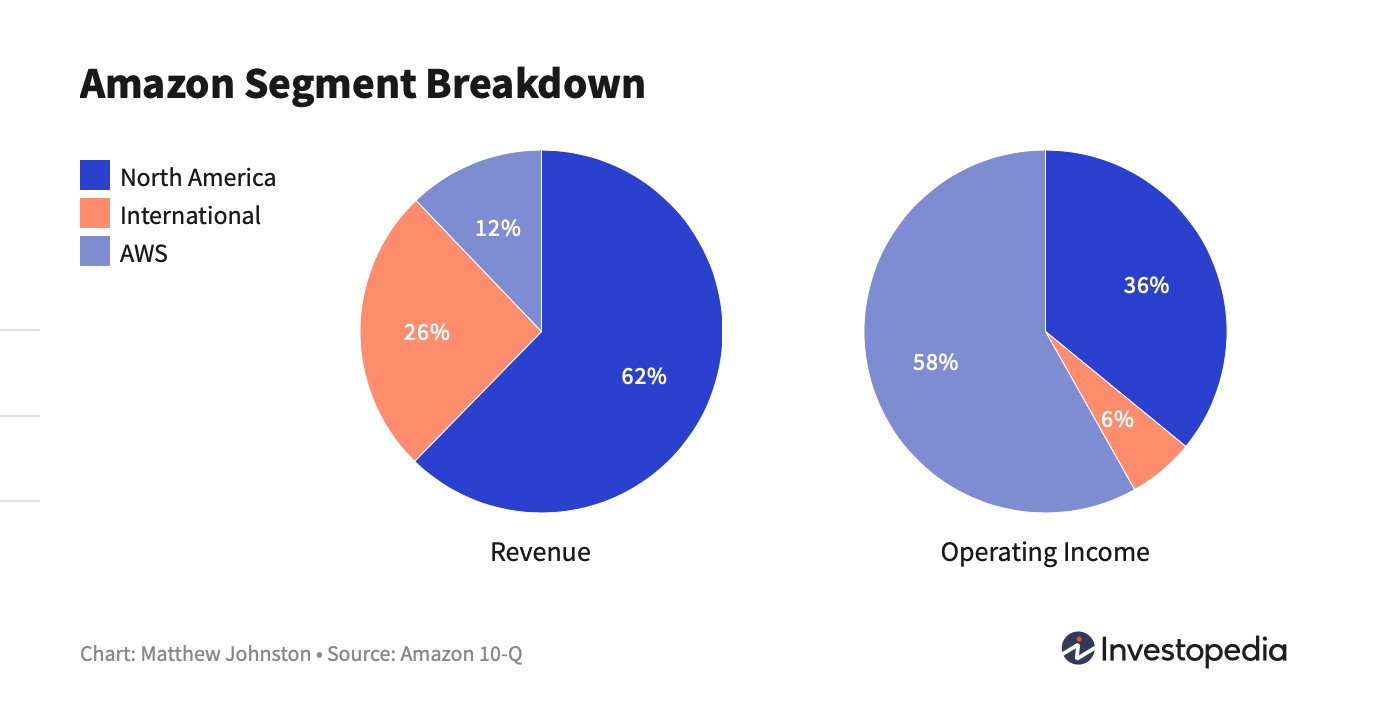

You might say that we just looked solely at revenue, and not profit. You’d be correct in assuming that Amazon makes a higher margin on its own products due to economies of scale and negotiating power, and that AWS is an even higher margin business due to low marginal cost. So low in fact, that AWS is 58% of Amazon’s operating income [4].

This is the measured power of platforms. Amazon was able to identify early on what it’s stored value and competitive advantage was in the market, and execute. It has paid off.

Can we apply this same concept of productization and platforms in other industries and companies?

Netflix’s Stored Value

While Amazon’s platform's value is readily apparent from looking at their current product offerings, companies also have stored value platforms that have yet to be productized. These are the types of platforms that one day could become productized externally and increase the overall revenue of the business.

Outside of its genius pivot from DVD rentals to streaming, Netflix is known as the $9.99 per month service that aggregates all of the TV shows and movies that you love into one service, available at any time on any device. This single product offering is differentiated by the user experience and the original content from Netflix’s own studios.

Many people have opinions on how Netflix can best grow and differentiate itself, like an article in HBR [5] which argues that Netflix should become a two-sided platform where content creators can put up content for sale and Netflix takes a cut of sales. While I disagree entirely given that the value is in original content and control over syndication, there’s another platform that Netflix is quietly building that could truly differentiate it.

Content Creation

Original content as a differentiator is why we see other streaming services come to market, like Disney, and become wildly successful without impacting Netflix much outside of market share. Netflix knows this and has been piling money [6] into the production of Netflix Originals and purchases of other original studio content [7].

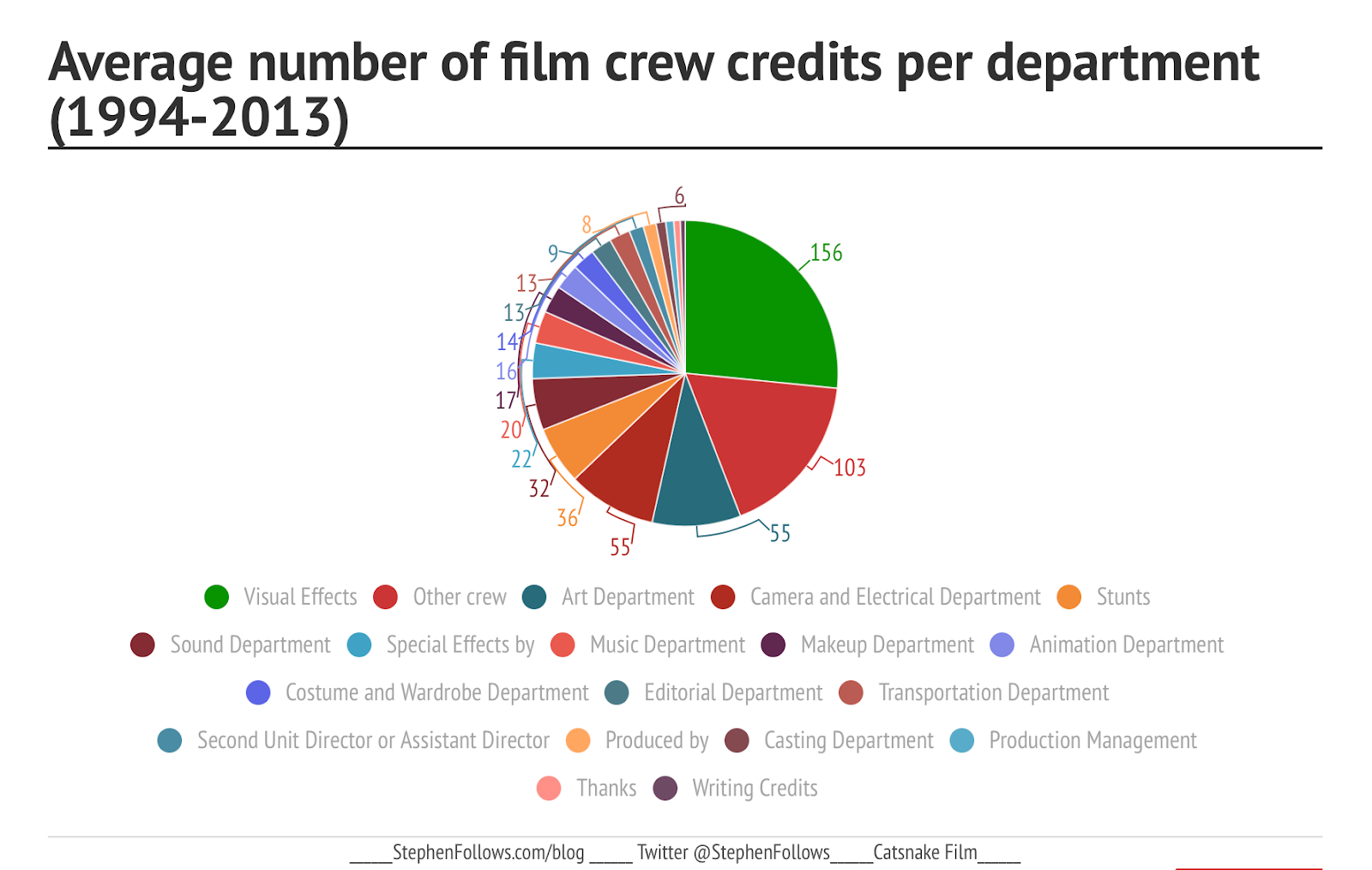

They are piling money into content because It’s hard and costly to create. There are many steps, and while I am not super familiar with the ins-and-outs TV and film production studios, I do know that it’s complicated and takes a lot of people [8]. Just look at any movie credit reel.

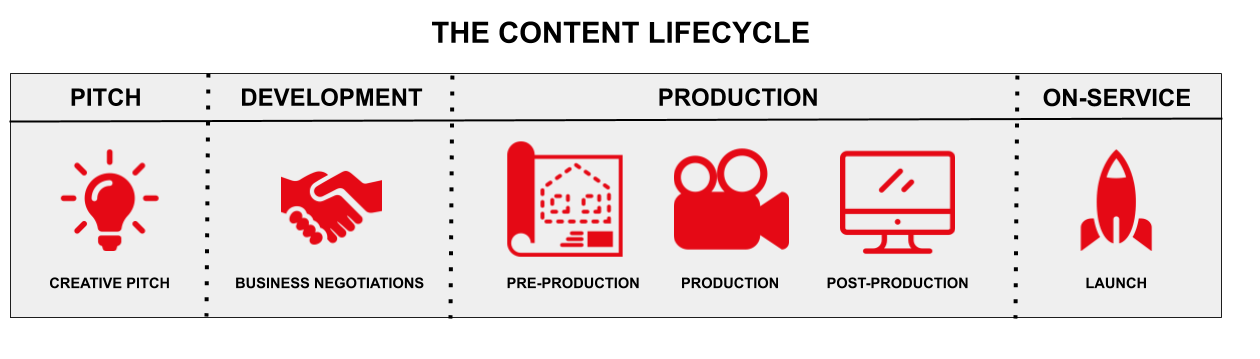

Netflix’s engineering blog [9] has a great high-level visual of the steps required to create content and launch a film or TV show. The crew in the pie chart above needs to fit into each of these steps, be coordinated, use expensive equipment, and travel to either a studio or sites where filming can happen.

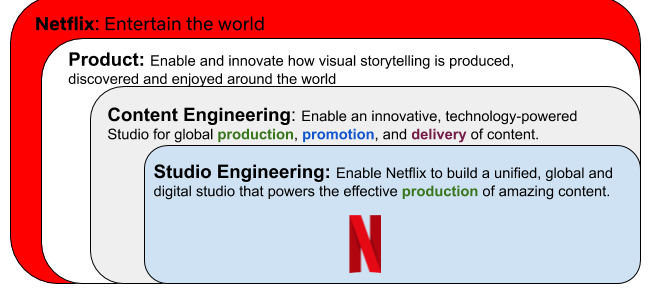

It’s complex. So complex that full software engineering organizations build tools to support the production of the amazing original content that Netflix puts out. Their mission? To enable Netflix to build a unified, global, and digital studio that powers the effective production of amazing content.

This mission is stored value: a digital platform to streamline a very costly and prominent part of Netflix’s business. Stored value that will increase as Netflix scales its studio.

Studio Platform

It’s that type of platform that will help Netflix maintain its dominant position in the market for its current streaming offering. The value is clear: they can streamline TV and film production, making it easier and cheaper to create original content with digital tools.

Imagine a world where Netflix becomes not just a streaming service, but also a streamlined platform that powers content production for itself and its content partners.

If Netflix can enable content creators to create content through Netflix studios as Netflix branded originals, they can leverage their position in the market as a dominant studio for content creators. They may also leverage this posturing to take percentages of ownership in original content, spread risk across a portfolio, and influence production in the same way as corporate venture capital.

Only time will tell with Netflix’s internal platform for content creation, but it’s exactly this type of internal stored value that’s waiting to get productized and picked up in the market as long as they can maintain their competitive advantage. If anyone is at the scale to make this content creation easy, it’s Netflix.

Other platforms

The Amazon and Netflix examples are a show of true strength and dominance, leveraging scale and expertise to productize what makes them great. There are many other examples of both external and internal platforms that either are or could be productized in the market as a second revenue stream for companies.

AngelList

One that has been in the news lately is the move of AngelList to become a platform for venture capital. The founders of AngelList started with a site to connect startups who needed seed money with venture capitalists. Now, leveraging the community they’ve built, the knowledge of venture capital investing, and experience going through the process, they are empowering up-and-coming venture capitalists to create their own funds on the AngelList platform. [10]

Epic Games

They’ve been in the news for a lot lately, but Epic Games has a similar story to Amazon and AWS. Epic Games is a gaming studio that’s been around since the early 90’s and has a bunch of hit games, including the most recent, Fortnite. To build your games you need a game engine. Unreal Engine has become a dominant platform in game development, beating out other large players like Unity. They built a great game engine, productized it, and are reaping the benefits at low marginal costs and high profit margins. [11]

Uber

Everyone knows the taxi-killing company who started as black cars only and made their way into a technology and ridesharing giant. Uber also happened to build out a food delivery service called Uber Eats in 2014 which has become a major player in the food delivery market. They are glad they did because earlier this year it was announced during a quarterly earnings report that Uber Eats revenue outpaced ridesharing revenue due to COVID-19. In doing so, they identified stored value in their network of drivers and ride hailing app features to set up a second platform that’s carrying them through right now. [12]

What’s next?

While the concept of productization isn’t new or novel, I found the sheer amount of productized platforms from an internal store of value like infrastructure expertise a key strategy for scaling companies and identifying diversified revenue streams.

If these companies can leverage their stored value in a way that empowers others in the industry while playing into their profits, they’ll continue to be more dominant than those who have a single product line. It’s about identifying that value and getting it to market.

I try and remind myself that there’s lots of value in the tools, not just the house. Platforms are powerful.

[0]: https://www.investopedia.com/terms/p/productize.asp

[1]: https://www.jimcollins.com/concepts/the-flywheel.html

[2]: https://www.technologyreview.com/2011/10/31/257406/who-coined-cloud-computing/

[3]: https://www.ben-evans.com/benedictevans/2020/9/6/amazons-profits

[4]: https://www.investopedia.com/how-amazon-makes-money-4587523

[5]: https://hbr.org/2018/08/the-best-way-for-netflix-to-keep-growing

[6]: https://www.digitaltrends.com/movies/most-expensive-netflix/

[7]: https://digiday.com/future-of-tv/netflix-content-spree-creators/

[8]: https://stephenfollows.com/how-many-people-work-on-a-hollywood-film/

[9]: https://netflixtechblog.com/netflix-studio-engineering-overview-ed60afcfa0ce

[10]: https://techcrunch.com/2020/09/08/angellist-pioneers-rolling-vc-funds-in-pivot-to-saas/

[11]: https://en.wikipedia.org/wiki/Unreal_Engine

[12]: https://qz.com/1889602/uber-q2-2020-earnings-eats-is-now-bigger-than-rides/